Canadian Real Estate 11/21/25

Perspectives After 3Q25 Results

Canadian REITs have been a safe haven in 2025 with a total return of +8.3% (XRE to 11/26) after a decline of only -6.7% when US tariff fears peaked in April. US-dollar based investors earned an additional +2.5% through Canadian dollar appreciation. US REITs’ total return has picked up to 5.3% in 2025 due to optimism about lower interest rates.

Key Ideas

Office Properties in prime locations should deliver improved performance in the next 12 months. Major employers need more space to accommodate increased office presence. Successful leasing in 2024-2025 will deliver improved cash flow in 2026-27 after free rent periods expire. Improving property fundamentals and debt availability support a rebound in transaction volumes which should lead to increased confidence in REIT equity values.

Retail REITs delivered strong operating results with vacancy rates at long-term lows. Landlords are are building value by adding density at existing locations where they already own land and have an established market presence. High occupancy also enables them to improve productivity by curating their tenant list. Bankruptcies like Hudson Bay and Toys R Us (likely) create more opportunities than problems.

Industrial REITs trade at lower valuations than most US peers despite superior Canadian fundamentals.

Multifamily REITs face continued uncertainty due to loss of demand from population growth while government policies promote construction of new supply.

H&R disbanded its Special Committee after failing to find a satisfactory transaction for the entire REIT. Management announced agreements to sell $1.5Bn of assets (after guiding 11 days earlier to $2.6Bn of sales). The REIT was unable to disclose any details of the additional sales or implications for its future strategy during the 3Q25 conference call. The uncertainty frustrated analysts and investors leading to a drop in the unit price (see 11/17 article for additional comments).

Dream Unlimited offers the best long-term value in the sector at its 11/21/25 price, but investment in an insider-controlled company requires acceptance of the strategy and time horizon of the controlling shareholder. Catalyst-oriented investors should look elsewhere.

Sector Overview

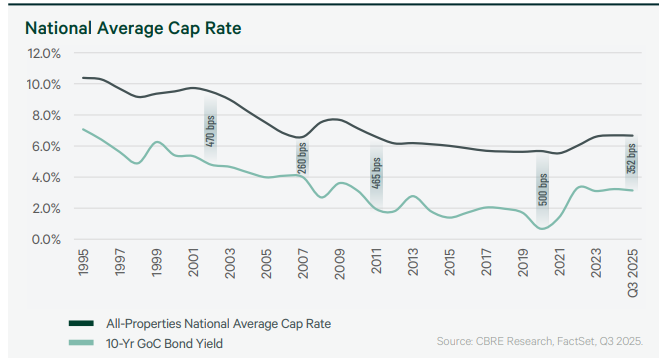

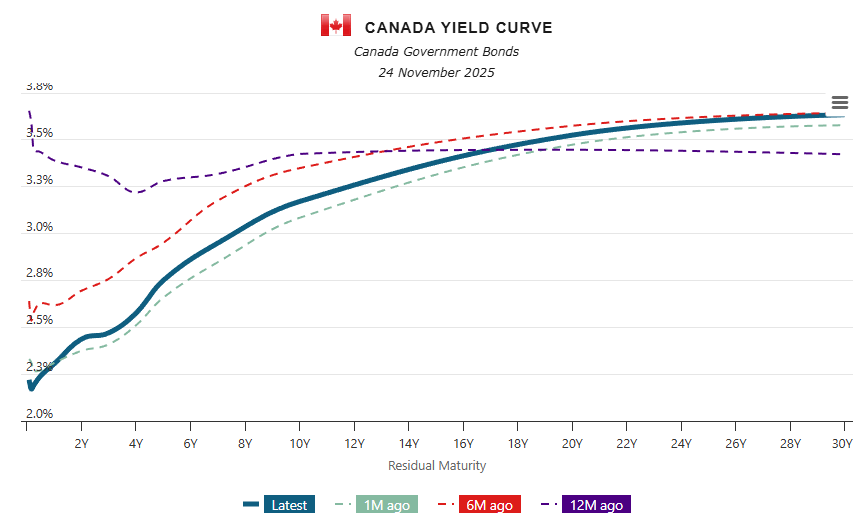

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range (and the GOC yield is +1bp since 9/30/25). However there has been a significant curve steepening with short-term yields corresponding to most REIT debt issuances sharply lower in the past year (CORRA -155bp, GOC 2-year -91bp, and GOC 5-year -53bp).

REIT bond yield spreads continued to improve in 9M25 with spreads for many issuers 150bp below 12/31/23 levels and most 3-4 year debt yielding under 3.5%. REITs with access to the unsecured public debt market can refinance on reasonable terms and invest with a positive return on their leverage. Few REITs are in a position to raise equity at current valuations, but North American REITs in every sector have been able to step up capital recycling through sale of non-core assets and reinvestment into acquisition or development of properties most suited to corporate strengths.

Insiders at 25 of 37 REIT/REOCs have been buyers since 12/31/24 (to 11/21) and 6 have had net insider sales. After very light activity from May-September, buying picked up in recent weeks with purchases at 15 REITs/REOCs and net sales at 2. . REIT/REOCs have repurchased $773mm of equity ytd (reported to 11/21) with the largest buybacks at Artis (5.8% of market cap), Minto (4.6%), Primaris (4.5%) and Interrent (4.4% of market cap). Some REITs that were aggressive buyers in 1H25 reported no buybacks in September-October (Riocan, CAPREIT, Granite, and Minto).

Topics

Office Section with perspective from US peers and comments on Allied Properties, Dream Office, Ravelin, and True North

Retail Section with a recap of development and investment activity

Industrial Section with comments on Granite and Dream Industrial

Diversified Section with comments on H&R, Artis, and Morguard REIT

REOCs with comments on Dream Unlimited, Melcor, and Morguard Corporation