H&R REIT: Special Committee Disbanded, What Now?

H&R (TSX:HR.UN) is still +13% ytd (to 11/14/25) despite Friday’s crash in the unit price and investor confidence following 3Q25 earnings and news that the Special Committee concluded its work without a sale of the REIT. Most of the assets are solid and the $865mm of confirmed sales will fortify the balance sheet. There is no crisis. Management still seems committed to realize full value from Residential, Industrial, and Retail assets and then realize what they can for the rest. But investors will remain cautious until the increased uncertainty over the future path has cleared.

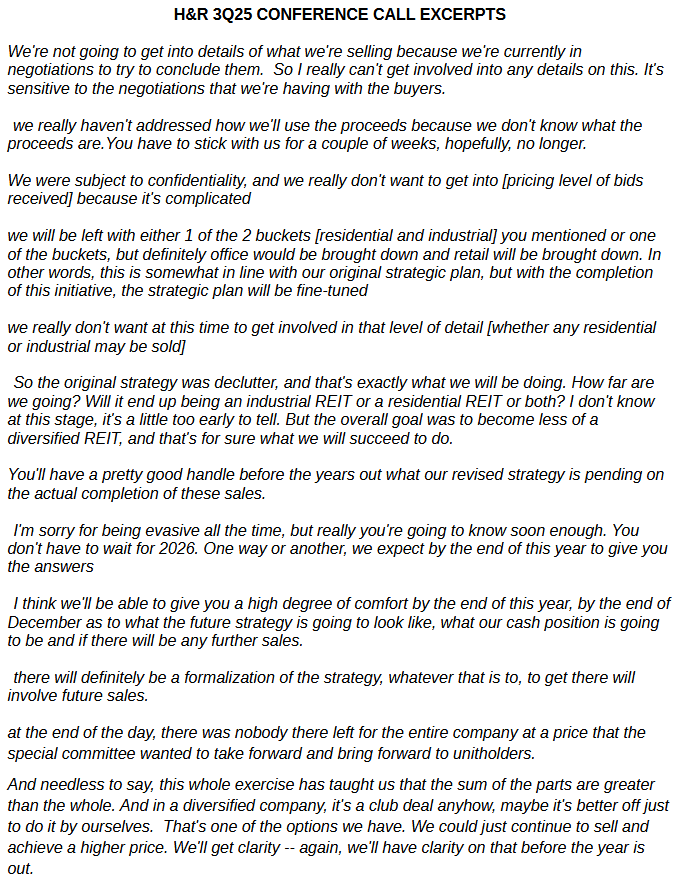

It’s hard to articulate a bullish argument for H&R when the REIT is unable to explain what business plan it will follow and what assets it will own. On Friday’s conference call management made no formal comments about the Special Committee process and tried to say as little as possible in Q&A, while promising more disclosures by year-end:

Key points from 3Q25 results:

$865mm of assets were marked as “Held For Sale” based on board approval for deals with a high probability of closing within one year. The list includes Hess Tower which is 2/3 leased to Chevron for 10 years, but largely vacant following Chevron’s acquisition of Hess. It also includes 2 Toronto office locations previously seen as condo redevelopments, but management says buyers are now more interested in continued office use.

$420mm of fair value losses in 3Q ($753mm ytd) hopefully bring carrying values to levels where transactions can be executed. I had hoped that was the case after $281mm in 2Q25, but evidently the bids received through the Special Committee process were lower.

Residential SPNOI was -3.4% yoy. One year ago management expected a strong rebound in rents and income by 2026 as a temporary Sunbelt supply surge was absorbed. A weak labor market has slowed growth in demand and all US multifamily REITs have negative ytd total returns:

Lantower is offering one month free rent on new leases at most properties, and higher concessions at two in the Dallas area (West Love and Midtown)

Fair value losses caused H&R’s leverage metrics to rise and the call explained that debt reduction was the first priority for asset sale proceeds.

Total sales of $2.6Bn expected to be announced by year-end exceed the 9/30 “Held For Sale” by $1.735Bn. Everybody wants to know what’s in this balance.