Dream Unlimited: Compounding NAV and Confounding Investors

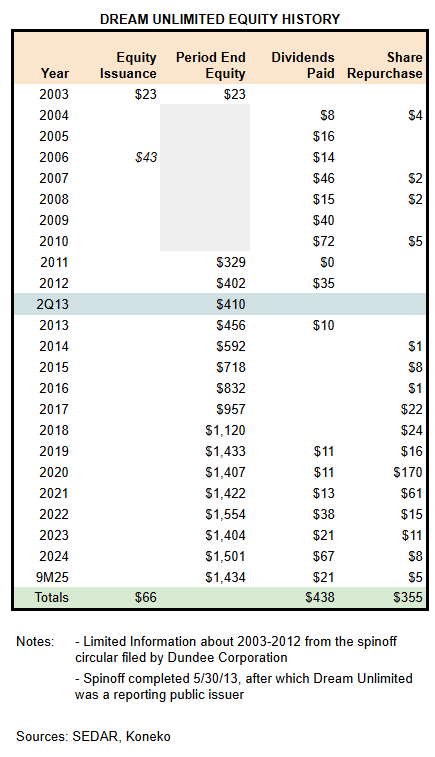

Dream Unlimited (DRM) was created in 2003 with $22mm of equity from Dundee Corporation and Michael Cooper. An additional $43mm was invested in 2006. It has paid $438mm in dividends, spent $355mm on share repurchase, and equity has grown to $1,434mm. The rate of value creation has remained one of best among public Canadian real estate companies following spinout from Dundee in May 2013.

Yet as a public company DRM has generated a negative total stockholder return. The share price is still below its split-adjusted $27.30 close on its first day of trading (5/30/13).

Topics

History of Dream Unlimited - Milestones from 1994-2025

Ownership and Governance - Founder Michael Cooper owns 43% of the shares and controls 87% of the voting rights. Dream does not have a corporate culture of investment by other executives and directors.

Corporate Structure - 4 public companies and 6 private funds

Asset Value - Choose your own adventure. Pick a number from “Standalone Book Value” of $26.72/share to “Illustrative NAV” of $51.68.

Underappreciated Growth - continued expansion of Asset Management and stabilized Investment Properties have been temporarily obscured by losses on Toronto assets.

Investment Narrative - Dream has tried too hard to pitch a simple story

Dream Industrial - the leading Canadian industrial REIT with multiple drivers of continued value creation

Dream Office - a concentrated portfolio of high quality Downtown Toronto offices benefiting from a strong market rebound. It should consider privatization or seek a new growth strategy.

Dream Impact - a distressed holder of some high quality assets. Some positive changes are underway. DRM is protecting its exposure by moving up in the capital stack.

Dream Global - revisiting the hugely successful launch, growth, and sale of an international REIT

The article attempts to cover a lot of ground, but the TLDR is simply the initial table. At its current valuation, DRM’s superior long-term growth provides the best opportunity in the Canadian real estate sector for investors willing to accept the complex scope of the business and volatile reported earnings.