Tickle Me Elme

Elme Communities (ELME) projects that sale of its remaining assets by 3Q25 will enable liquidating distributions of $2.35-$2.80/share. That would be an attractive return from the current price around $2.20, but the REIT’s poor disclosures and history of disappointments suggest the market is right to be wary of those values. I attempt to fill in the details and arrive at a potential worst case outcome of $2.12, indicating slight downside risk if everything that could go wrong, does go wrong.

Liquidation History:

Announced a liquidation plan in August 2025 with estimated total distributions of $17.58-$18.50 per share (LINK)

Sale of a majority of multifamily assets in November for $1.6Bn (LINK)

Initial Distribution of $14.67 per share paid in January (LINK)

Updated and reduced guidance of remaining net assets of $2.35-$2.80 per share (LINK)

Topics:

Analysis of sales under negotiation (including Watergate offices)

Analysis of remaining sales (including Riverside Apartments)

Company background is in the May 2025 Investor Presentation

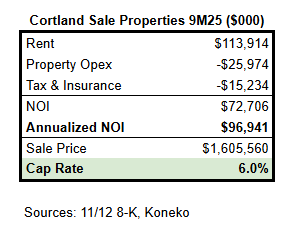

Cortland Sale

On 8/4/25 Elme concluded its Strategic Review and announced the sale of 19 properties to Cortland Partners for $1.6Bn (LINK). Jay Parsons shared insights about the portfolio (newer vintage apartments in attractive northern Virginia submarkets) and noted that Cortland passed on 3 properties in Montgomery County MD (possibly due to rent control) and 2 older properties in DC. Moshe Crane profiled the Cortland communities here.

Upon completion of the Cortland sale, Elme filed an 8-K that included financial statements for the sale portfolio and the remaining assets. From this we can estimate a 6.0% cap rate.

Pending Sales

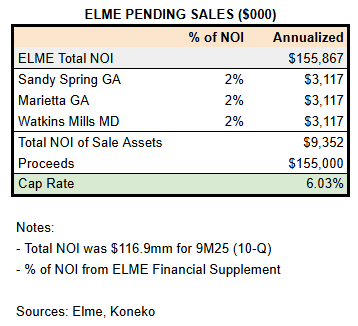

Elme’s 1/23/26 update disclosed agreements to sell 3 of its remaining assets for gross proceeds of $155mm.

Pricing looks attractive, however the single digit disclosure “% of NOI” means that rounding might have a big impact. If each were 1.6% of NOI then then cap rate would be 4.8%, but if each were 2.4% of NOI then the cap rate would be 7.2%.

One of the properties is in Montgomery County MD so rent control is not an insurmountable obstacle.

Sales Under Negotiation

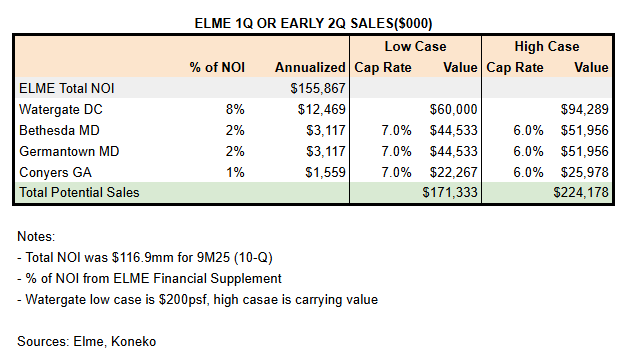

Elme’s 1/23 update disclosed that it “expects to finalize the sales of the two remaining Maryland properties, the one remaining Georgia property and Watergate 600, Elme’s only office property, in the first quarter or early second quarter of 2026.” I infer that the reduction in expected liquidation proceeds reflects the current pricing of these deals under negotiation. This group includes the assets with the most uncertainty - the Maryland properties subject to rent control and the Watergate office.

I suspect that a disappointing outlook for Watergate is the primary reason for the downward revision in guidance.

Watergate 600

This 300ksf Class A office building is in an attractive location adjacent to the Potomac, the Trump Kennedy Center, and the Saudi Embassy. Elme talked about selling it for several years prior to announcing its liquidation plan. Failure to find a deal over that time is a cautionary signal.

Book Value is $95mm, after a $41mm impairment recorded in 2023

Occupancy was 82.9% at 9/30 and has been drifting lower

Largest tenant is Atlantic Media with approximately 140ksf expiring in 2027. AM sold the building to Elme in 2017. AM sold the Atlantic Magazine to Lauren Jobs and the magazine offices moved to a new location in 2022. AM’s primary business is now National Journal, a high end advisory and business intelligence firm. I never heard of it before yesterday, but it is reportedly stable and profitable. If this Loopnet information is accurate, the AM space is available from 11/1/27 and the building’s occupancy could drop as low as 32%.

EIG Global Energy Partners is another major tenant, occupying 51ksf on the top two floors with an 18-year lease signed in 2019

Elme commented in 3Q24 that it was signing smaller Watergate leases at $55-67 psf - about in line with the average for Washington DC Class A space ($61.26 per CBRE)

Leasing uncertainty makes the property hard to value. A significant renewal from AM would facilitate a cap rate valuation similar to current book value. If AM leaves then it would become a repositioning value-add play that might be worth $200psf to a buyer willing to invest in upgrades and releasing, or a residential conversion (very viable in this location).

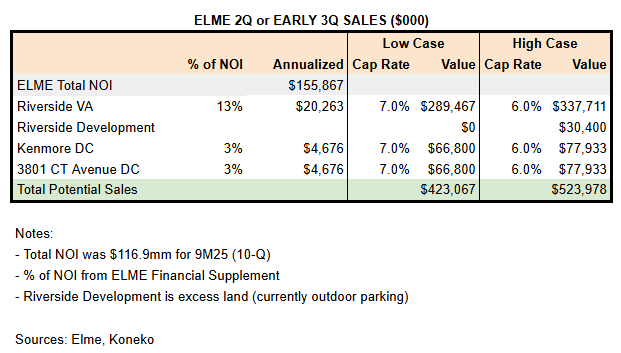

Final Round of Sales

Elme’s 1/23 update explained that it “expects to commence a formal marketing process for Riverside Apartments later this month and to continue the marketing process for the two D.C. properties, with a goal to have these three remaining properties under contract by mid-May. Elme continues to target completion of the sale of all 10 remaining properties by mid-year 2026.”

Value depends heavily on the three building Riverside Apartments complex in Alexandria VA. I suspect that the large size and uncertain development potential explain why it was not included in the Cortland sale.

Riverside Apartments

Occupancy was 95% at 9/30/25 and one month lease concessions are currently being offered. Elme proposed to redevelop the surface parking areas of the 21 acre parcel into new apartments. The REIT is carrying a $30.4mm development asset of costs incurred to date, and it might be worth that, or nothing.

Valuation

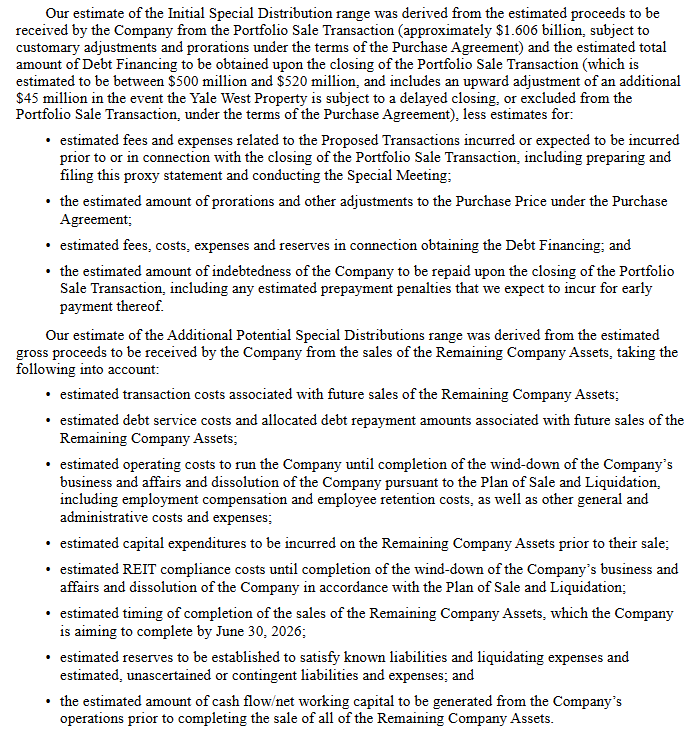

Elme has provided almost no disclosures to support its estimate of liquidation proceeds. Management said on the 2Q25 call that all the details would be in the proxy statement, but that only included a list without dollar amounts, and there was no 3Q25 call:

Based on my analysis of pending sales and guesses about expenses, I arrive at valuation range wider than management guidance.

The low end of my range reflects worst case outcomes across the board: 7% cap rate on all remaining multifamily, Watergate sold at a discounted square foot valuation, zero value for the Riverside Apartments development potential, and a full-year of operating expenses in addition to severance.

It would be hard to do worse than that, but the high debt level creates some macro risk if there’s an economic crisis in the few months. The debt costs SOFR+225 which can mostly be covered by NOI now that ELME is no longer paying distributions.

The upside is that management probably has a good handle on the remaining assets to be sold within six months and the midpoint of guidance is $2.58, most of which could be paid by the end of 3Q25 - the initial liquidating distribution came 2 months after the Cortland sale. I’m comfortable with the balance of risk vs reward. Downside is low, and the high end of guidance is not impossible. The high leverage makes it difficult to be too precise about the net amount that can be distributed.

Disclosures and Notes:

At the time of publication the author held shares of Elme Communites. This disclosure should not be interpreted as a recommendation to purchase this security and this holding may change at any time. Investors are encouraged to check all of the key facts cited here from SEC filings, company disclosures, and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication.

This article is published free in its entirety because I am new to the story and may have made some errors. Feedback is welcome from anybody who may know additional or alternate details.