Canadian Real Estate Earnings Preview

And Trade Ideas Update

Canadian REITs began 2026 with a +6.0% total return (XRE to 1/23) with strong rebounds from some 2025 losers. US REITs returned +2.3%.

This article previews topics that will be of of interest in upcoming earnings reports and includes brief comments on trade ideas mentioned in prior articles.

Topics

Office Sector with comments of Dream Office and Allied Properties

Retail Sector with comments on Choice and Primaris

Industrial Sector with comments on Dream Industrial

Multifamily Sector with comments on Mainstreet

Diversified Sector with comments on H&R and Morguard REIT

REOCs with comments on Dream Unlimited, Morguard Corporation, and Melcor Developments

Other with comments on Artis, Ravelin, and Dream Impact

Sector Overview

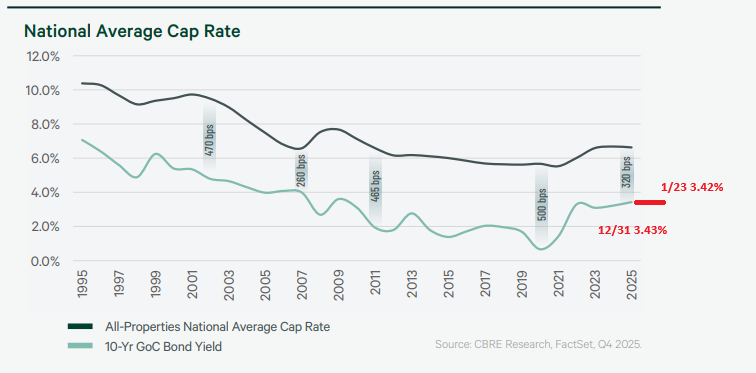

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range.

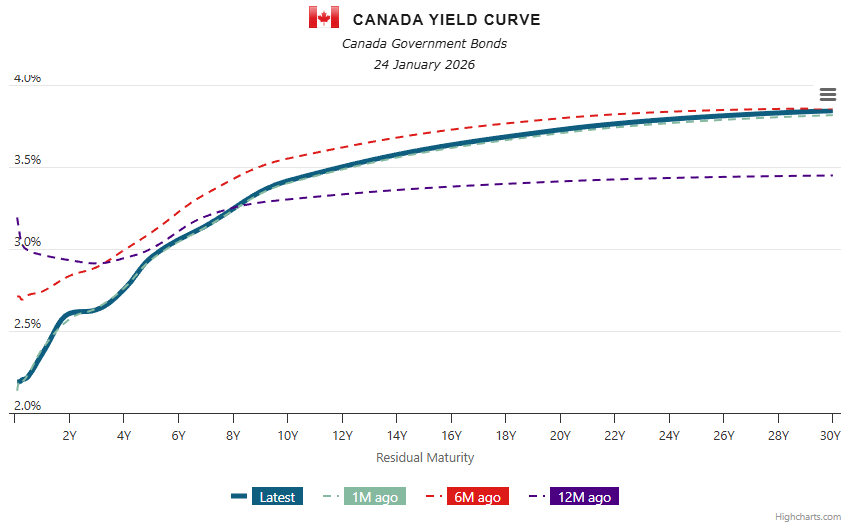

The yield curve has steepened with short maturities sharply lower in the past year (CORRA -103bp, GOC 2-year -33bp GOC 5yr -5bp). A steeper yield curve signals higher future growth expectations that would be more beneficial to economically sensitive Industrial and Retail Assets.

Insiders at 24 of 38 REIT/REOCs were buyers since 10/1/25 and 3 had net insider sales. REIT/REOCs have repurchased $179mm of equity since 10/1 (reported to 1/23) with the largest buybacks at CAPREIT, Artis, Boardwalk, and Dream Unlimited.

Trump risk is likely to affect markets again in 2026. Investors repeatedly convince themselves that everything will be calm after the newest crisis is averted. But conflict and drama are essential to Trump’s personality and politics. The Trump Show must introduce one plotline after another. Optimists may ultimately be correct that the USMCA (CUSMA) trade agreement will be renewed this summer, but Trump will only sign a deal after a fight. One commentator said Trump could have gotten everything in the rumored Greenland agreement by just asking. But asking is not winning - it was never going to be an option. Businesses don’t want trade conflict. Investors don’t want trade conflict. But there will be trade conflict, because the weekly premise of the Trump Show is that Trump fights and Trump wins. Mark Carney’s eloquent Davos address triggered Trump’s insecurities over his intelligence and lack of elite respect. Investors should expect a fight that will create a buying opportunity.

Early last year a savvy reader asked: “Why would anybody invest in Canada?” For a decade that skepticism paid off, but in 2025 the TSX beat the SPX by 14 points, Canadian REITs beat US REITs by 7 points, and the Canadian dollar rose 5% vs the US dollar. I think Canada remains attractive, but also heavily exposed to the US so I have been looking for more international ideas. One Hong Kong stock included in my year-end trade ideas is +7% ytd and I will try to post another soon with good liquidity.