Brandywine Realty: High Cost Debt, Index Deletion, And Dividend Cut

A Path Back To $10

Shares of office landlord Brandywine Realty (BDN) have dropped to a 15 year low. The REIT has good assets concentrated in Philadelphia and Austin, but a balance sheet burdened by high cost debt and preferred financing. In the next three months the share price is likely to rebound from recent setbacks (index deletion, tax selling etc…) In the next three years the price could recover more strongly to $10 as development projects are stabilized and high cost capital is replaced through asset sales and refinancings, but this potential comes with execution risk and economic risk.

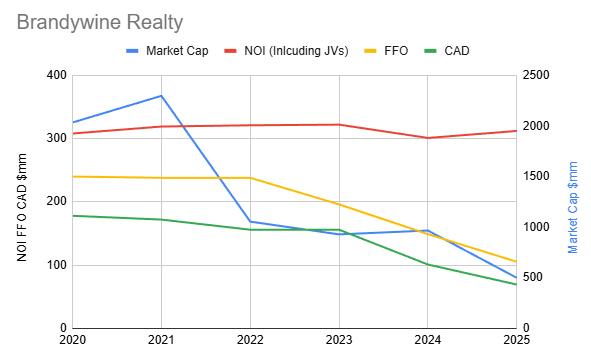

The drop in Brandywine’s share price is a rational reaction to deteriorating cash flow. NOI (property operating performance) has been steady, but FFO and Cash Available for Distribution have dropped due to rising interest expense and financing costs reported through development joint ventures. If the REIT is able to reduce the amount of its debt and the cost of its debt then cash flows and share values can rebound because the underlying property income has not deteriorated.

Topics:

Index Deletion - removal from the S&P600 will take effect on 1/6/26

High Cost Debt and Preferred - BDN has almost $1Bn of outstanding debt costing over 8% and preferred obligations with yields into the teens

Properties - Philadelphia core portfolio is far outperforming market averages

Development - Philadelphia Schuylkill Yards is extremely attractive mixed-use project, but has yet to find tenants for a recently completed life sciences office building.

Properties - Austin portfolio is outperforming market averages, but the market is very weak due to an excess of new supply.

Development - Austin Uptown ATX is an attractive mixed use project, but weak markets for both office and multifamily mean the potential will probably be realized more than 5 years in the future.

Governance - Brandywine lacks strong independent directors and active shareholders.

Valuation and A Path to $10 - Brandywine is currently valued at a cap rate of 9.7%. Stabilization of the balance sheet and development projects could drop that to 7% in 3 years enabling shares to rebound to $10.