Canadian Real Estate 11/7/25

Headlines led to some sector volatility in recent weeks and opportunities to execute the trade ideas mentioned in my prior article.

Canadian REITs have been a safe haven in 2025 with a total return of +8.8% (XRE to 11/7) after a decline of only -6.7% when US tariff fears peaked in April. US-dollar based investors earned an additional +2.0% through Canadian dollar appreciation. US REITs’ total return was only +4.4% in 2025.

Sector Overview

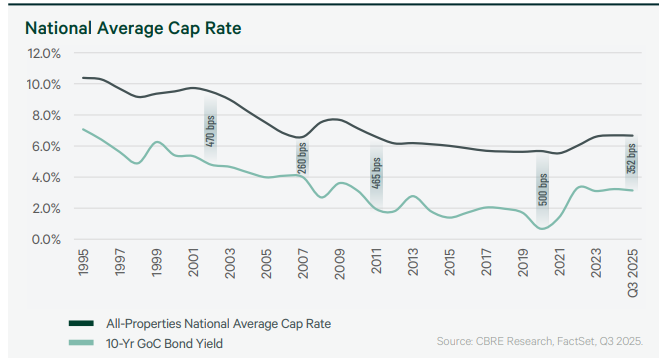

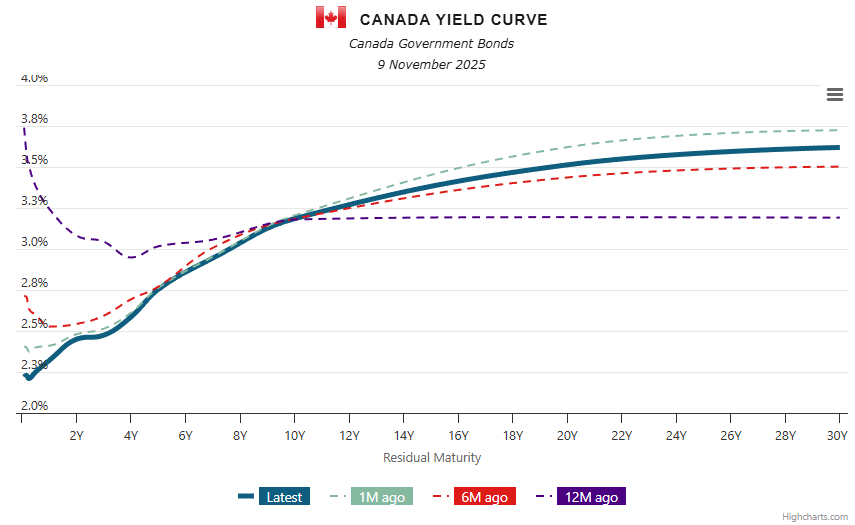

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range (and the GOC yield is unchanged since 9/30/25). However there has been a significant curve steepening with short-term yields corresponding to most REIT debt issuances sharply lower in the past year (CORRA -154bp, GOC 2-year -63bp, and GOC 5-year -27bp).

Insiders at 25 of 37 REIT/REOCs have been buyers since 12/31/24 (to 11/7), however buying dropped sharply since April and there were very few purchases in recent weeks. 4 Issuers had net insider sales. REIT/REOCs have repurchased $770mm of equity ytd (reported to 11/7) with the largest buybacks at Artis (6.1% of market cap), Minto (4.7%), Primaris (4.5%), and Interrent (4.3% of market cap). Some REITs that were aggressive buyers in 1H25 reported no buybacks in September-October (Riocan, CAPREIT, Granite, and Minto).

The sector remains attractive with many companies able to provide favorable returns through ownership of quality properties and organic growth strategies. However, the drop in insider and repurchase activity suggests that investors can be patient and reserve some capital to take advantage of bargains that are periodically created. Uncertainty following Trump trade threats triggered all but one of the Trade Ideas described in my 10/10 article; updates are included below. Trump’s falling approval rating is leading to nearly daily efforts to shift the US economic narrative, sometimes with tariff threats, but his willingness to pressure trade partners seems very limited due to the adverse impacts of confrontation on the stock market, business, and consumer confidence.

Topics

Valuation Comparison

Quick Takes (Artis, Dream Office, Dream Industrial, Granite, Allied Properties, H&R, Morguard REIT, Melcor Developments, Dream Unlimited, and Dream Residential)