Canadian Real Estate Update After 2Q25 Results

Return to Office REITs

Canadian REITs have been a safe haven in 2025 with a total return of +10.5% (XRE to 8/15) after a decline of only -6.7% when US tariff fears peaked in April. US-dollar based investors earned an additional +4.2% through Canadian dollar appreciation. US REITs’ total return was only +3.3% in 2025, and negative for international investors due to the declining US dollar.

Key Ideas

H&R disclosed that a board special committee has been reviewing strategic alternatives since receiving unsolicited buyer interest in February (see 7/9 article for additional detail and commentary). Sale of the high quality and highly marketable Residential, Industrial, and Retail segments could net $12.63/unit after repayment of all corporate debt, leaving $4.91/unit of value that could be realized over time from the more problematic Office segment.

Office in prime locations should deliver improved performance in the next 12 months. Major employers need more space to accommodate increased office presence. Successful leasing in 2024-2025 will deliver improved cash flow in 2026-27 after free rent periods expire.

Retail REITs delivered strong operating results with vacancy rates at long-term lows.

Industrial REITs trade at lower valuations than US peers despite superior Canadian fundamentals.

Multifamily REITs face continued uncertainty due to loss of demand from population growth while government policies promote construction of new supply.

Sector Overview

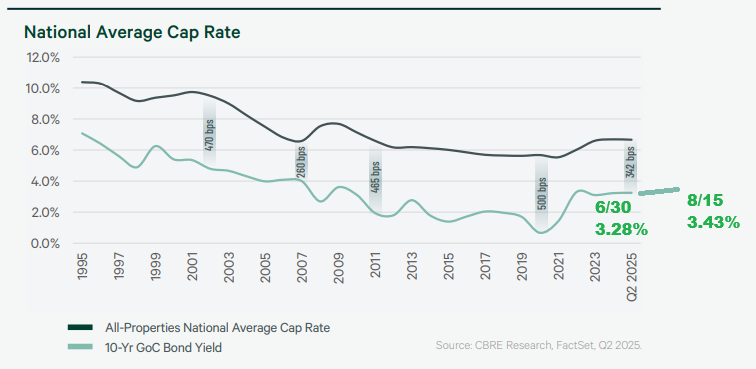

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range. Cap rates are less volatile than bonds - the spread tightens when bond yields rise and expands when bond yields fall. If higher rates reflect increased confidence in economic growth then it will lead to higher demand for real estate.

REIT bond yield spreads continued to improve in 1H25 with spreads for many issuers 150bp below 12/31/23 levels. REITs with access to the unsecured public debt market can refinance on reasonable terms and invest with a positive return on their leverage.

Insiders at 25 of 37 REIT/REOCs have been buyers since 12/31/24 (to 8/15), however buying dropped sharply since April. 4 Issuers had net insider sales. REIT/REOCs have repurchased $732mm of equity ytd (reported to 8/15) with the largest buybacks at Artis (4.6% of market cap), Minto (4.5%), Interrent (4.4% of market cap), and Primaris (4.2%).

The sector remains attractive with many companies able to provide favorable returns through ownership of quality properties and organic growth strategies. However, the drop in insider activity suggests that investors can be patient and reserve some capital to take advantage of bargains that are periodically created by macro news such as the tariff driven drop in Industrial and the HBC driven drop in Retail. Markets have assumed minimal impact from Trump/tariff developments. The Bank of Canada estimates that 95% of Canadian exports can enter the US free of tariffs under the USMCA (CUSMA) treaty. No REITs mentioned it as a major factor in 2Q leasing decisions.

Topics

Office Section with perspective from US peers and comments on Allied Properties, Dream Office, True North, and Ravelin

Retail Section with a recap of development and investment activity

Multifamily Section with comments on Dream Residential and Morguard Residential

Industrial Section with comments on Granite and Dream Industrial

Diversified Section with comments on H&R, Artis, and Morguard REIT

REOCs with comments on Dream Unlimited, Melcor Developments, and Dream Impact