Canadian Energy Strategic Reviews (Updated 5/9 for free release)

Two high Quality E&Ps Seeking to Maximize Shareholder Value

Advantage Energy (AAV) and Kiwetinohk Energy (KEC) are attractive due to:

Recently announced Strategic Alternatives reviews driven by leading energy sector PE firms

Highly productive assets with long reserve lives in attractive basins

Strong economic logic to industry consolidation

Significant insider buying

The appeal of these stocks is not dependent on a forecast for commodity prices, however both are likely to benefit from increased Canadian LNG export capacity.

The fair value for each stock fluctuates with commodity prices, but I believe they will deliver excess returns through successful outcomes from their Strategic Reviews.

Topics:

Recent Canadian Energy M&A (CNQ-Chevron, Ovintiv-Paramount, Tourmaline-Crew, Vermilion-Westbrick, Whitecap-Veren)

Commodity Outlook (Oil neutral, Canadian Natural Gas favorable)

Advantage Energy Profile (Montney Natural Gas with 24 year RLI, Entropy Carbon Capture)

Advantage Kimmeridge Standstill Agreement (6% Ownership stake, selection of 3 Directors)

Advantage Value Creation (Past return comparable to peers)

Advantage Shareholder Base and Insider Activity (13 Insider buyers in past 12 months)

Advantage Path Forward (Most likely will merge with Birchcliff)

Kiwetinohk Profile (Created by energy PE firm ARC Financial and grew through 2 key acquisitions)

Kiwetinohk Shareholder Base and Insider Activity (7 insider buyers in past 12 months, 75% owned by 2 funds)

Kiwetinohk Value Creation (impressive growth without dilution, but weak share price)

Kiwetinohk Path Forward (Most likely will be acquired by CNQ)

This article has been slightly updated since its original publication for paid subscribers on 4/9/25.

THE BENEFITS OF CONSOLIDATION

Kimmeridge Energy Management (KEM) has articulated the benefits of energy industry consolidation for nearly a decade through an excellent series of research reports:

More efficient development over larger land packages. More efficient use of services. Better bargaining power with service providers and midstream companies.

G&A savings through elimination of overlapping executive overhead.

Lower Cost of capital. Better availability and lower cost of debt. Higher equity value.

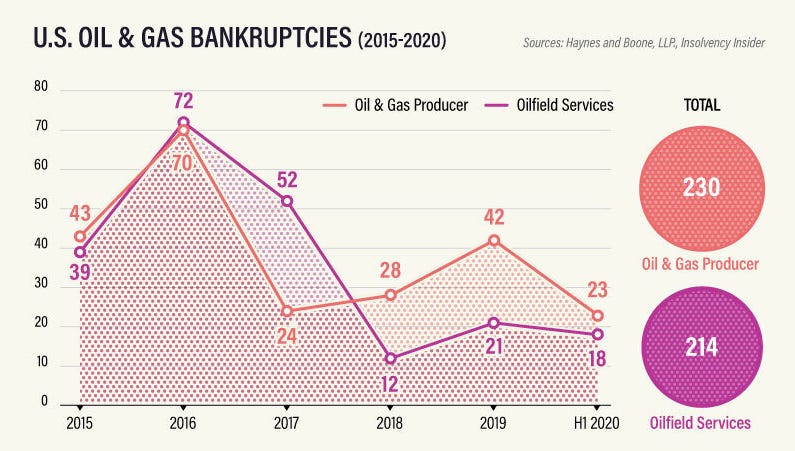

Twenty years ago the sector offered opportunities for nimble small-caps to create value through exploration and new development techniques. Now exploration is very limited and companies concentrate on exploitation of known resources through refinement and enhancement of known processes. Twenty years ago capital markets were optimistic about potential returns and provided low cost funding. The lengthy energy bear market resulted in hundreds of bankruptcies. Generalist investors fled and the limited remaining capital has favored larger stronger companies with more conservative capital management.

Kimmeridge argues that there are far too many small E&Ps. The industry and investors benefit from mergers. A 2018 presentation included this table of 15 small/mid cap public E&Ps operating in the Permian Basin. Only 4 remain independent - of those only Diamondback has been a great success.

Kimmeridge has now turned its attention to Canada where it sees similar opportunities for consolidation: Kimmeridge eyes more Canada oil and gas activism amid trade war, underperformance. A standstill agreement signed with Advantage in March disclosed a 6.3% stake.

"Ultimately, we think (tariffs and the trade war are) going to be long-term positive for the Canadian industry, because it will force them to look outside the U.S. and diversify their export markets into Asia," Viviano said in an interview on the sidelines of the CERAWeek conference.

"We think that it needs to be consolidated, given how fragmented the industry is, and we think we have a number of poor-performing management teams and boards which are preoccupied with growing production instead of generating shareholder value"

Consolidation potential in Canada appears comparable to the US:

In a May 2025 Kimmeridge calculated that key Canadian Basins would have leading productivity in the next decade: “Ranking of the top five basins by annual average recycle ratio”:

Kimmeridge has argued that “merger of equals” transactions can deliver greater value to investors because all of the synergies are shared by the investors in the two companies. When a large company buys a small one it will pay an initial premium, but then all the synergy benefits are diluted over a much larger market capitalization.

RECENT CANADIAN ENERGY M&A

There have been several significant Canadian energy deals in the past year:

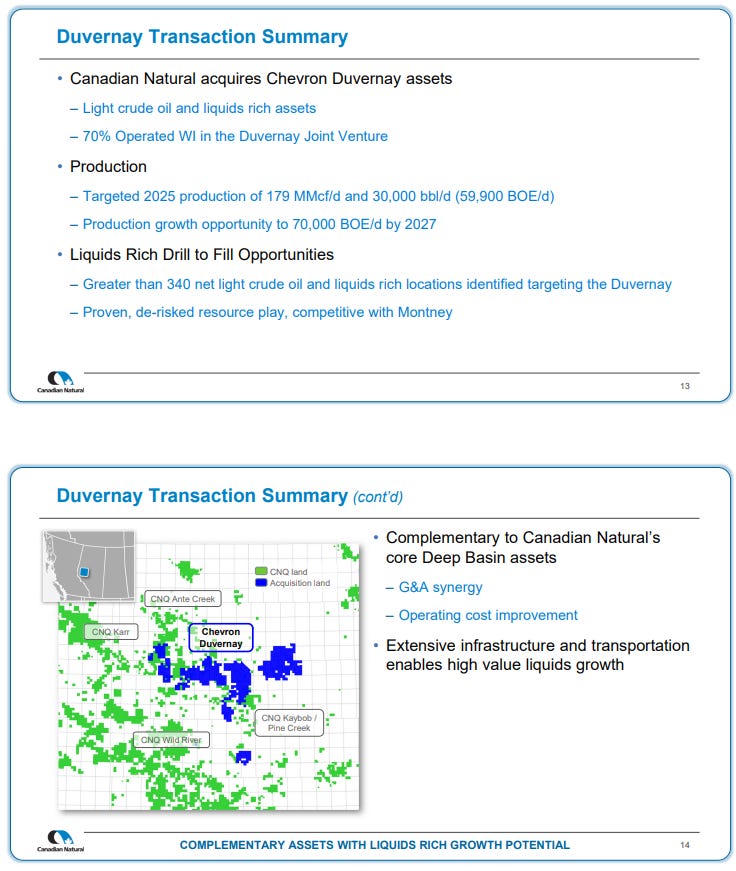

Canadian Natural Resources (CNQ) bought Chevron's Canadian assets for $8.8Bn. Most of the value was attributable to a stake in the Athabasca Oil Sands Project, but it also included Duvernay shale interests directly adjacent to ones held by Kiwetinohk. CNQ highlighted the Duvernay operating synergies it would realize from the transaction and an aggressive 3 year growth plan:

Ovintiv acquired Alberta Montney shale interests from Paramount Resources for $3.3Bn. Paramount will continue to operate the remainder of its assets, mostly in the Duvernay shale. Ovintiv sold its own Duvernay assets to Kiwetinohk in 2021.

Tourmaline Oil purchased Crew Energy for $1.1Bn. Crew held Montney gas producing fields similar to those operated by Advantage. TOU explained: “this is an opportune time for consolidating natural gas assets prior to imminent major growth in the North American LNG business and acceleration of natural gas-powered electrical generation requirements across the continent”. TOU has an outstanding record of growth through acquisitions and has become the largest Natural Gas producer in Canada, and 4th largest in North America.

Vermilion Energy acquired Westbrick for $1.1Bn and explained: “we expect to realize operational and financial synergies including capital efficiency improvements, infrastructure optimization, gas marketing opportunities and other corporate synergies”. It was a competitive deal process, but Vermilion was a logical buyer because it held adjacent assets.

Whitecap and Veren will merge with a combined value of $7.5Bn. The companies highlighted their position in the Alberta Montney (near Advantage) and Kaybob Duvernay (near Kiwetinohk).

Obviously each field still has a large number of operators leaving clear opportunities for additional consolidation. The M&A market is active and any company with decent assets can be acquired. All these transactions were friendly so the willingness of management and board to pursue a deal is the dominant driver of whether a company participates.

One implication of Alberta energy industry consolidation is reduced demand for Calgary office space. Following the sale of its Canadian operations to CNQ, Chevron's entire 261,500sf Calgary office building is now on the market, “vacant and ready for a new identity”.

COMMODITY OUTLOOK

Energy sector commentary is dominated by macro analysis and equity investors can fall into a trap of believing they need to forecast OPEC, Trump, Putin, Venezuela and so on. In this episode of long-time sector expert Paul Sankey’s weekly video, he works through the impossibly complex macro environment including the “absolutely massive and epic” end to the “global economic construct” and the implications for the dollar, gold, bitcoin, and the risk-free interest rate. Unless you're trying to medal in the Investing Olympics those predictions are too competitive and it’s too hard to find an edge in making them.

Short-term energy share price movements have a very high correlation with the spot price of oil:

Forecasting short-term oil price trends is difficult, maybe even for Paul Sankey, but the long-term movement has been … zero, because there's no fundamental scarcity. An oil bull market seems very unlikely because the current price level depends on voluntary OPEC production restraint and the future price level will face increasing challenges from EV adoption.

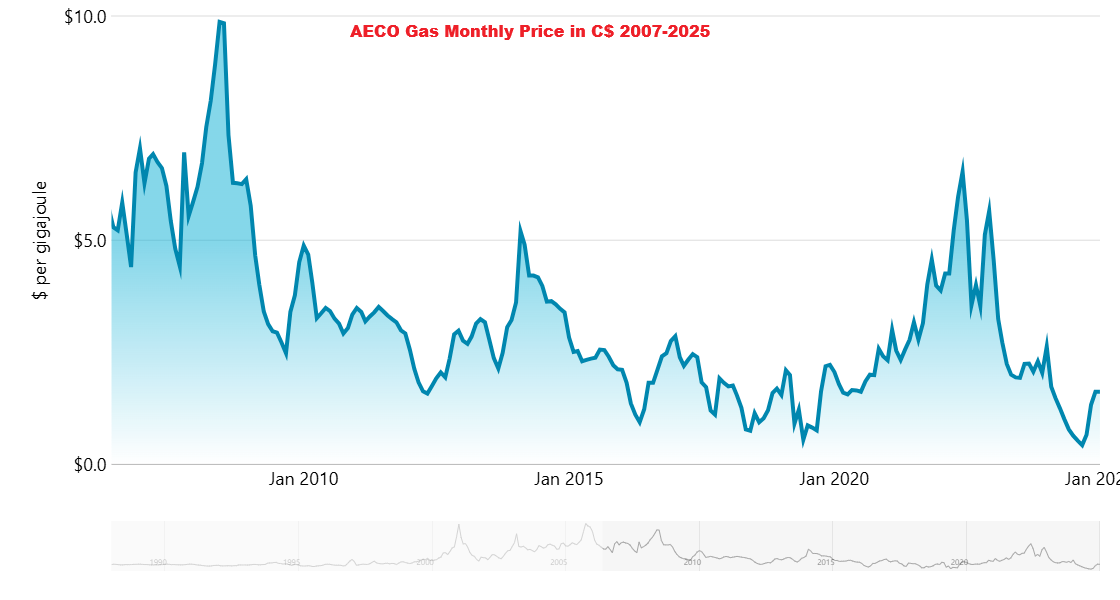

The outlook for Natural Gas is more favorable with electrical generation demand boosted by data centers and domestic manufacturing, plus retirement of aging coal plants. Short-term gas prices are volatile due to the variability of heating/cooling related demand and Canadian gas prices have had especially high volatility because production has to travel long distances to US Markets. Alberta benchmark gas prices have been below C$3 for most of the past 15 years and the daily spot price occasionally turns negative because the pipes are full.

The future outlook is more favorable due to construction of LNG export terminals on the British Columbia coast with export capacity equal to 30% of Canada's current production.

Canadian gas will go from receiving the lowest price in North America (as a marginal supplier to the US market) to accessing much higher global prices. Canada has significant advantages over US Gulf Coast LNG exports due to lower liquification cost (lower starting temperature in Canadian climate), shorter shipping distance to key Asian markets, and avoidance of the Panama Canal. The long-term demand outlook is reflected in Alberta gas futures prices for most of the next five years over$3/mcf, well above the average since 2010. Canadian gas producers have the opportunity to sell higher volumes and realize higher prices.

The commodity outlook provides a favorable environment for Canadian Natural Gas producers such as Advantage and Kiwetinohk. The thesis is widely understood and might be fairly reflected in equity valuations, but once in a while the Canadian gas producer share prices are overwhelmed by oil-price driven macro sentiment. Recent weakness provides an attractive entry with potential for corporate transactions at AAV and KEC to enhance returns.

ADVANTAGE ENERGY (AAV) PROFILE

Advantage has been in independent public company since 1997. Its key assets are:

Montney natural gas – AAV has a concentrated land position of high performing wells with a 24.4 year reserve life. Additional detail is in the latest company presentation.

Montney gas infrastructure – AAV estimates the replacement cost of its processing plants and other infrastructure at $1Bn. This seems very reasonable because in the depth of the bear market in April 2020 AAV sold a 12.5% interest in its Glacier Gas Plant to Topaz Energy for $100mm (implying a retained value of $700mm at that time)

Entropy Carbon Capture – AAV incubated the Entropy carbon capture business in collaboration with the University of Regina. The basic chemistry of carbon capture using an amine solvent was discovered nearly 100 years ago. Entropy's innovation is the development of an extremely efficient solvent that binds more easily to CO2 gas and then releases it more easily in a heat chamber. Many companies are talking about Natural Gas power generation with carbon capture, however Entropy has the only facility in the world in commercial operation (installed at the AAV Glacier gas plant). In 2022 Entropy signed a financing arrangement with Brookfield Renewable under which BEP would provide $300mm of funding in exchange for a 50% equity interest. In 2023 Canada Growth Fund invested $200mm for a 20% interest which gives the most recent implied value of $350mm for AAV's retained 35% stake. It's important to separate Entropy from the Enterprise Value attributable to the E&P business when valuing AAV.

Advantage is a natural target for Kimmeridge:

Natural Gas. Kimmeridge is enthusiastic about Natural Gas, directly owns gas producing fields in the Texas Eagle Ford shale, and acquired a controlling interest in Commonwealth LNG which is building a LNG export facility in Louisiana. Kimmeridge is especially enthusiastic about the long-term potential of the Montney Basin.

Climate Kimmeridge has been a strong proponent of climate solutions and said: “net zero by 2030 should be the standard for the energy sector”. From an interview in The Deal: “An ideal company for the energy transition, according to Mark Viviano, is one that generates significant cash flow from oil production and pumps it into carbon storage.” In 2022 KEM committed $200mm to Chestnut Carbon which generates credits through reforestation.

ADVANTAGE KIMMERIDGE STANDSTILL AGREEMENT

Advantage released a series of unexpected disclosures:

2/25/25 Board Chairman retired and replacement named

2/28/25 Formed Special Committee “to review strategic opportunities that are in the best interests of Advantage and its shareholders:”

3/6/25 Appointed 2 new independent directors and disclosed their selection was part of an agreement with Kimmeridge. Advantage committed to add a third director selected by Kimmeridge at the 2025 AGM, and that ended up being Katherine Minyard. The new directors appear highly qualified and bring M&A experience.

In the Standstill agreement filed on SEDAR Kimmeridge disclosed ownership of 10,536,900 AAV shares (6.3% of outstanding) as of 3/6/25. KEM commits to not acquire more than 20% of total AAV shares. The AAV position is relatively small for Kimmeridge which has US$4.8Bn in AUM and Its most recent 13F disclosed 3 large holdings (Sitio Royalties US$699mm, Expand Energy US$629mm, and Civitas $191mm). KEM has capacity to acquire more, and should be more confident in the value creation potential after the board changes. Not having its own representative on the Board enables Kimmeridge to acquire shares with only limited disclosure requirements.

Kimmeridge appears to be closely involved in driving the strategic review and is very likely to be buying more shares, but will not have to make any official disclosure until its holding crosses 10%.

ADVANTAGE VALUE CREATION

Advantage has delivered a return comparable to Canadian peers. I don't think it has been mismanaged.

However it faces these challenges:

Share buyback – in recent years AAV has allocated 100% of free cash flow to share repurchase. The fundamental problem with such E&P share buybacks is that cash flow is highest when commodity prices are highest and then share prices also tend to be highest. Buying at the highs minimizes the value creation. Canadian industry leader Tourmaline has wisely taken the opposite approach and rewards investors with regular cash dividends, plus special dividends when free cash flow is high.

Charlie Lake Acquisition – in 2024 AAV acquired its “Charlie Lake” locations which are close to its existing Montney operations, however the wells have higher oil output and higher variability. While the price may have been attractive and provide strategic synergies, investors have been uncomfortable with the increased complexity (compared to the very well established gas locations with predictably strong performance) and use of $450mm of cash which has since required allocation of free cash flow to deleveraging rather than share buyback.

Entropy will benefit from Canada Carbon Credits that are scheduled to rise steadily to C$170/tonne in 2030. AAV had hinted that Entropy could be spun off to shareholders in 2025, however the economic emergency caused by the Trump tariffs and the Canadian election create uncertainty about the long-term carbon pricing plan.

Scale – AAV has attractive assets, however its company production is only 21% of ARC and 12% if Tourmaline. Larger companies are able to realize more value from their production through pipeline and terminal commitments enabling them to receive pricing from the West Coast, or US Midwest, instead of the local Alberta energy market (AECO).

ADVANTAGE SHAREHOLDER BASE AND INSIDER ACTIVITY

Advantage reported C$2.4mm in insider purchases in the past year by 13 different insiders. That breadth of conviction and commitment is unusual.

Maybe they are all taking a view about the “global economic construct”. Or maybe they are highly confident in the company's asset value and strategic potential. While there was no public hint that the company would review Strategic Alternatives to maximize shareholder value, maybe the insiders knew it was possible.

ADVANTAGE PATH FORWARD

Willingness of Advantage to give control of 30% of the Board of Directors to an investor with a 6% stake suggests:

Support of other AAV holders. The only large disclosed position held by a reporting fund manager was 11.9mm shares at 12/31/24 controlled by Edgepoint (Canadian Portfolio and Canadian Growth & Income Portfolio)

Alignment of views. Kimmeridge appears likely to be supportive of AAV's business focused on natural gas and carbon capture.

The most likely and most feasible outcome would be a merger of Advantage with peer Birchcliff Energy which holds immediately adjacent properties. The operational fit is obvious. The companies are about the same size (AAV production 81,500 boepd vs BIR production of 77,500 boepd) so they would perfectly fit the Kimmeridge thesis of maximizing value through “merger of equals”. Once the companies were integrated after 1-2 years they could consider further transactions.

Large Caps Ovintiv and CNQ also hold property immediately adjacent to Advantage and could easily absorb it in lieu of a Birchcliff transaction, however the economic benefits would be diluted over the larger business scope.

In its 1Q25 conference call Advantage made a vague explanation that no transaction is currently under evaluation.

KIWETINOHK (KEC) PROFILE

Kiwetinohk was created by Calgary-based ARC Financial to build an Energy Transition company with integrated Natural Gas production, electricity generation, and carbon capture. It made two key acquisitions:

Distinction/Delphi Energy – KEC invested in a recapitalization of Delphi Energy which was under CCAA protection and later merged with the surviving Distinction Energy.

Duvernay licenses acquired from Ovintiv in 2021 while the latter was under activist pressure from Kimmeridge to deleverage.

KEC planned 7 power generation projects including 3 Solar farms, and four Natural Gas Power Plants. Solar became difficult due to a hostile regulatory environment in Alberta. The NGCC plants stalled due to the high construction capex, but the Opal project was sold at a pre-development stage in February 2025 for $21mm.

Unusually, KEC listed on the TSX without any share offering and just a limited public float held by former investors in Delphi Energy. The company has since been trapped by a combination of low liquidity and low valuation. It hasn't been willing to sell more equity (either public sale or as acquisition currency) because the price is too low. It hasn't been able to attract more investors because liquidity is too low.

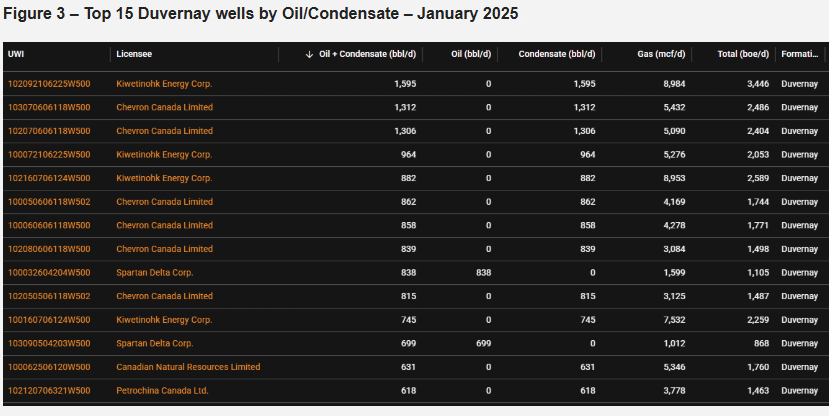

In conjunction with its 4Q24 earnings, KEC announced that it would review sale of part or all of its business:

CEO Pat Carlson explained in the conference call that the review would address the primary investor concerns:

KEC’s 1Q25 earnings release disclosed the engagement of NBF and RBC as advisors so the company seems committed to the review process.

KIWETINOHK SHAREHOLDER BASE & INSIDER ACTIVITY

Kiwetinohk reported $638k in purchases in the past 12 months from seven different insiders.

ARC has over $6Bn in AUM and a history of building energy businesses, creating and realizing value through investments in more than 180 companies since it formed in 1989. Kiwetinohk CEO Pat Carlson has led four ARC-funded companies from formation to buyout.

Passage Energy launched in 1998 and was acquired by Bonavista in 2001.

Krang Energy launched in 2001 and was bought by Viking Energy Trust in 2005

North American Oil Sands launched in 2002 and was bought by Statoil in 2007 for C$2.2Bn

Seven Generations Energy launched in 2008 and was acquired by ARC Resources in 2021 for C$2.7Bn

The ARC Energy Fund 8 launched in 2015 and ARC Energy 9 launched in 2019. As these funds age they need to get visibility into realizing the value of their holdings.

Luminus Management is a Houston-based PE firm that has contracted sharply in the past 5 years. Positions reported in its most recent 13F totaled $87mm compared to $4,941mm at 12/31/18. The KEC stake may be their largest remaining asset and they presumably need to sell.

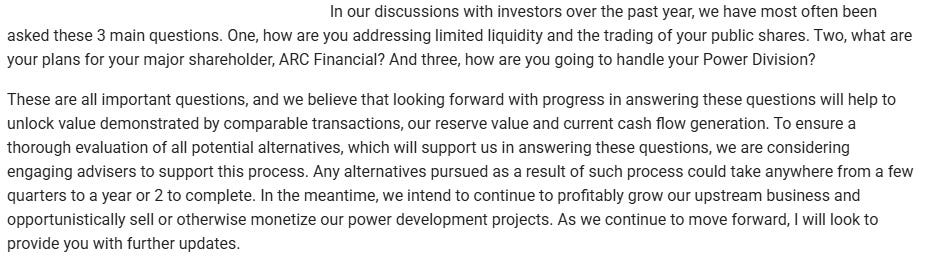

KIWETINOHK VALUE CREATION

Kiwetinohk has achieved impressive growth in production and reserves without equity dilution

However KEC's share price has lagged the sector since it listed in 2022 as low liquidity has severely limited investor interest.

KIWETINOHK PATH FORWARD

ARC's sector experience and strong financial interest makes it highly likely that the Strategic Review will result in a business combination. I believe a large public company is the most likely partner because the combination would provide enough trading liquidity for the ARC and Luminus funds to realize the value of their investments.

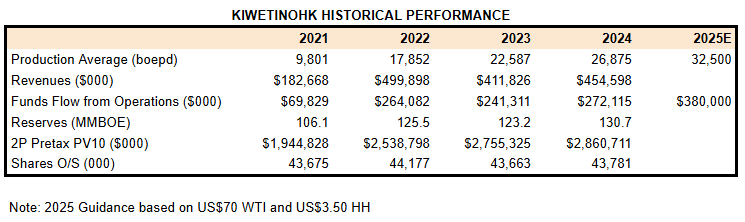

The most logical outcome is a cash acquisition by CNQ. KEC and CNQ (which bought the former Chevron locations) dominate the ranking of top performing Duvernay wells from their adjacent properties.

The list of other Duvernay producers is led by Whitecap/Veren whose merger is expected to close in 2Q25. They could be a position to consider merger with KEC from 2026.

Petrochina lands remain from the 2020 breakup of its Duvernay joint venture with Ovintiv. It might be a non-strategic asset for them which might be divested to another company on the list.

Merger of KEC with a private company could such as Parallax or Artis could realize operating synergies, but would not provide capital markets liquidity so it's an unlikely outcome.

Merger with Paramount's remaining operations (following its Montney sale to Ovintiv) is possible.

Disclosures & Notes

At the time of publication the author held shares of Advantage and Kiwetinohk. This disclosure should not be interpreted as a recommendation to purchase any of these securities. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

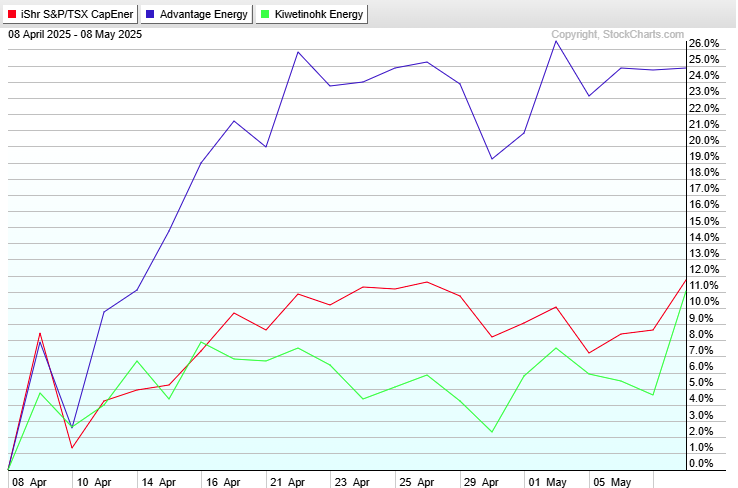

This article was published for paid subscribers on 4/8/25. In the past month AAV rose +25% while KEC was +11%, about the same as the TSX Energy Index.