Star Holdings: Sea Hear Meow

Quiet Progress Towards Liquidation

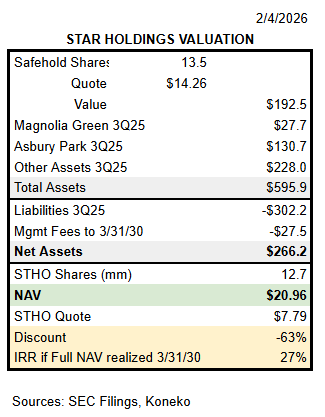

Star Holdings (STHO) is -39% since my October 2024 profile. Star’s equity stake in Safehold dropped 38% and development progress slowed due to weak housing markets and higher interest rates. STHO disclosures have been minimal, but the company continues to advance multiple projects with sales that should appear in 4Q25 and 2026 financial reports. New zoning applications in Asbury Park and Virginia increase the potential for good news in the next 1-2 years so I recently added to my position.

Star is not going to complete its liquidation by the original goal of March 2027, however progress over the past year makes a 2030 completion realistic. STHO repurchased 0.4mm of shares in 3Q25 and the opportunity for more capital returns should improve as assets are monetized.

See my prior profile for background on the company history and liquidation plan.

Star Holdings: Sugarman, Won't You Hurry?

Star Holdings (STHO) was formed in 2023 to manage the liquidation of the assets of iStar mortgage REIT following the spinoff of its successful ground lease business (Safehold – SAFE). There was an initial burst of value investor excitement over the 60% discount to an NAV that could be realized over a projected 4-year liq…

Key risks remain opaque governance/incentives and macro (interest rates and housing demand).

Asbury Park

Development is advancing on multiple parcels. Each successful project increases the appeal of the following ones. Compared to expectations from a decade ago, developments have lower density and higher price points. STHO is carrying its Asbury Park assets at $131mm. The hotel assets represent $67mm (undepreciated cost of $91mm).

Changes since my prior article:

The Views at North Shore was acquired by Hovnanian for $12.7mm in November 2025. This might include payment for The Delta parcel since I can’t find a separate sales record for it.

The Delta (formerly Delta Townhouse) is now controlled by Hovnanian which plans to launch presales soon. The marketing website indicates prices begin at $1.1mm.

Surfhouse rental apartments opened to residents last summer. Current availability looks like 20 units out of 226 and the property is offering a 1 month concession on new 13 month leases and 2 months on 18. The project is owned by a Crowdstreet joint venture, but STHO extended a $10mm mezz loan and a guarantee for a $80mm construction loan. The development appears successful so I expect to see a refinancing in 2026 that would repay the STHO loan and relieve the guarantee obligation.

Block 4004 townhouse development proposal was submitted in partnership with Toll Brothers in late 2024. There’s been no subsequent activity. STHO is still the property owner.

Block 3904 proposal was submitted in late 2024 for a development that would have 54 residential units and a parking garage with 333 spaces. There’s been no subsequent activity.

Block 3801 proposal was just submitted in January 2026. The design and density are completely consistent with neighboring blocks.

Block 3803 proposal was just submitted in January 2026. The design and density are completely consistent with nearby blocks (including 3801 proposed)

Remaining (4307, Beach Club, 3902, 4503) show no new activity.

Magnolia Green

Lots within the primary residential development have been nearly all sold. The latest satellite images show remaining red sections have been cleared for building, except for a couple of northern sections waiting for municipal road improvements.

Regional development near Magnolia Green will increase the community’s appeal. HCA is building a 60 bed hospital and medical center. Cloverhill Church is building a large school, church, and sports facility. A third party applied for approval to build 677 townhomes and apartments at Taylor Ridge. Another adjacent 131 acre property on Hull Street Road is reportedly under contract for sale.

STHO is carrying its Magnolia Green assets at $28mm which is certainly below the fair market value of the remaining residential lots, plus 99 acres designated for an Active Adult community and 96 acres Commercial.

Active Adult Community - STHO previously planned a senior community on this parcel, but was unable to partner with an operator in that sector so it received zoning approval in 2025 for a change to an “Active Adult (Age Restricted 55+) Community” of 900 units. The site seems to be available for sale in its entirety rather than through lots or portions.

Commercial - STHO received zoning approval in 2025 to remove restrictions on the building sizes and to allow a portion to used for residential development. A 14 acre parcel is reportedly now under contract for a 240 unit luxury apartment project. Prospects for the Retail and Office portions of STHO’s commercial sites should be improving as all the green spaces above are filled in.

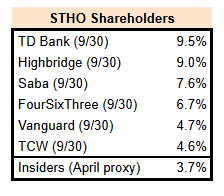

Bagholders

The roster of my fellow shareholders has not changed much and includes several activists.

Disclosures & Notes

At the time of publication I held shares of Star Holdings. This article and disclosure should not be interpreted as a recommendation to purchase any securities and this holding could change at any time. Investors are encouraged to check all of the key facts cited here from SEC filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

Interesting assets that Ive been following for some time. Two questions on valuation... what confidence to you have in SAFE's valuation? The fundamentals and chart are not comforting. Any risk of a margin call on STHO as SAFE is in free fall?

Second, should you be capitalizing the development and operating costs to ready these assets for sale? Last I looked at these assets they were burning significant capital each quarter in excess of the management fee. Do you expect this to change?