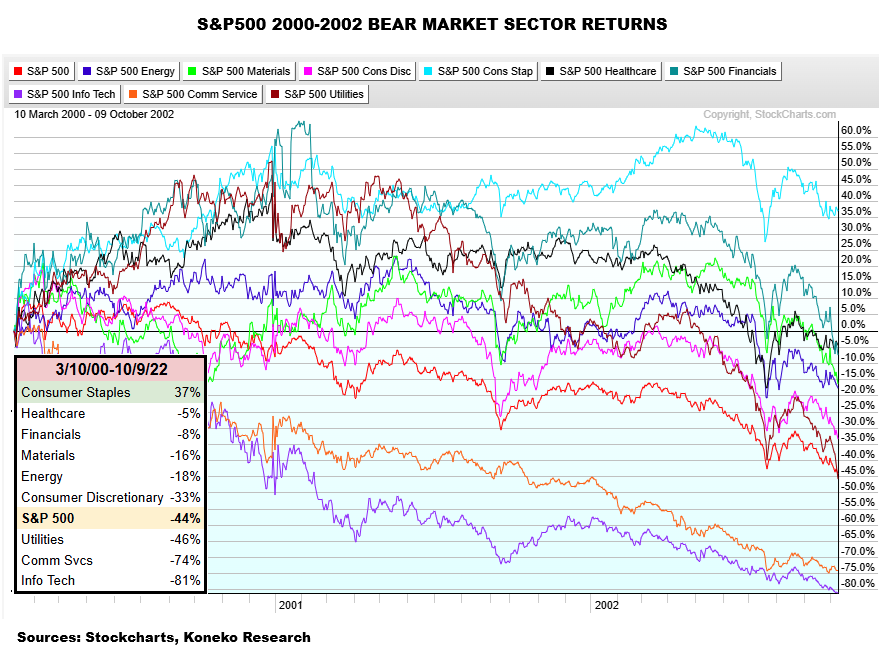

S&P Sector Returns In the 2000-2002 Bear Market

Consumer Staples was the only winner (+37%). Cyclical value sectors and emerging markets outperformed over a broader 1999-2003 time frame.

Thoughtful analyses are pointing to the rising dependence of the US economy on AI investments, consumer spending boosted by the wealth effect of AI equities, and the near impossibility of achieving a positive return on AI capex. The late 1990s internet/fiber/dotcom bubble is frequently cited as a comparison. Consumer Staples was the only S&P500 sector to deliver a positive total return in the subsequent bear market:

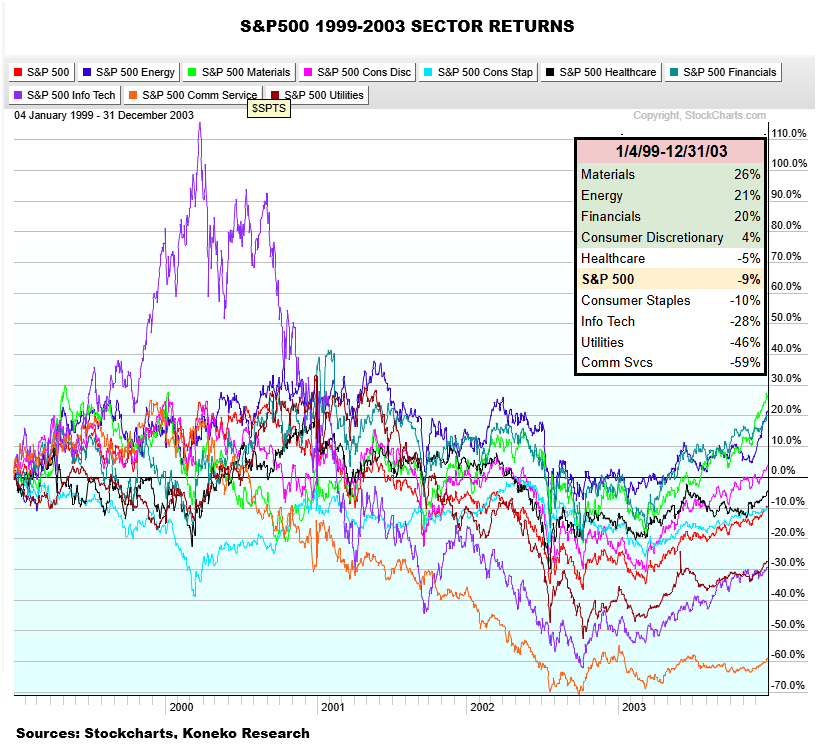

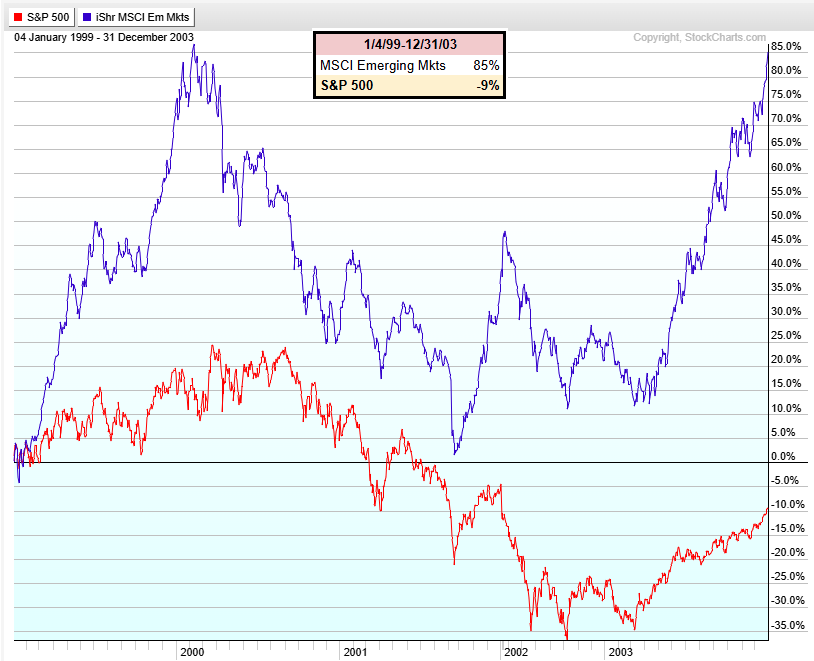

Calling market tops is difficult because there’s rarely a clear trigger for the decline. Even for some time past the peak, the drop can still be seen as a healthy correction. Looking at the dotcom crash from a wider time horizon shows that missing the final year of the rally and holding out-of-favor cyclical value sectors (Materials, Energy, and Financials) earned a positive return through the bear market and initial recovery. The adverse impact of the recession was more than offset by the benefit of the shift from restrictive to accommodative monetary policy (Fed funds rate fell from 6.5% in 2000 to 1.0% in 2003).

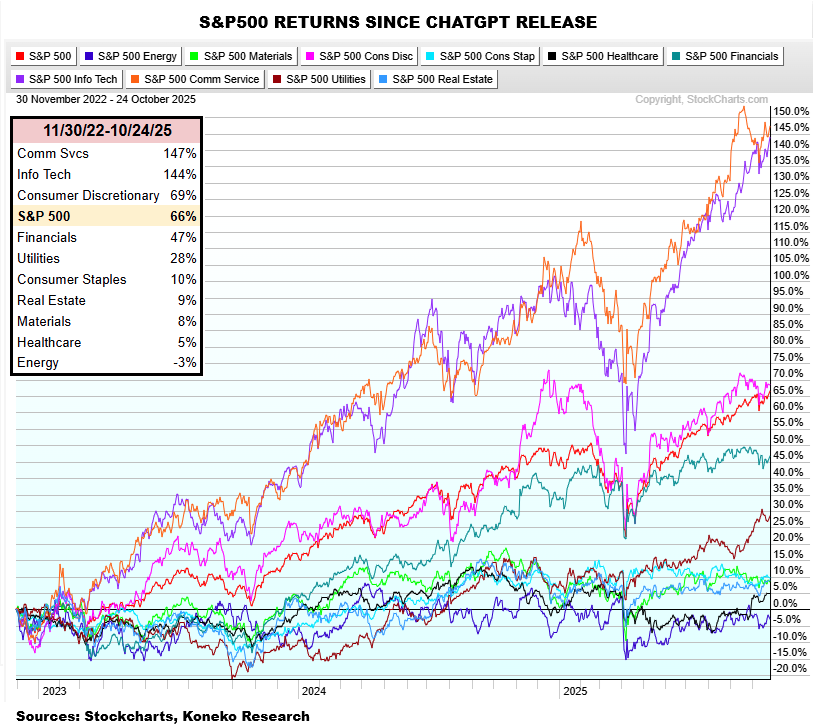

The AI equity bubble poses a significant risk to investors in the sectors directly exposed, but also to the broader S&P500 index. The 1999-2003 experience shows that investors can preserve capital and earn attractive returns at lower risk through holding sectors that lagged the bull market, but will benefit from lower interest rates:

Opportunities:

Real Estate: I have written frequently about the sector, and especially Canadian real estate (Articles, Notes, Subscriber Chat). Values will be enhanced by falling interest rates and valuations will been enhanced by improving investor sentiment. Recent insider and corporate buying has been limited so I think a buy/add on weakness mindset is best right now and suggested attractive equities and price levels in my most recent article.

Energy: I shared perspectives on the Energy sector in April and commented on two Canadian E&Ps conducting strategic reviews. I continue to hold both stocks and expect favorable outcomes to their reviews, however I feel neutral about the near-term prospects for the sector. Outperformance for both stocks that I profiled has already priced in some of the potential deal benefits.

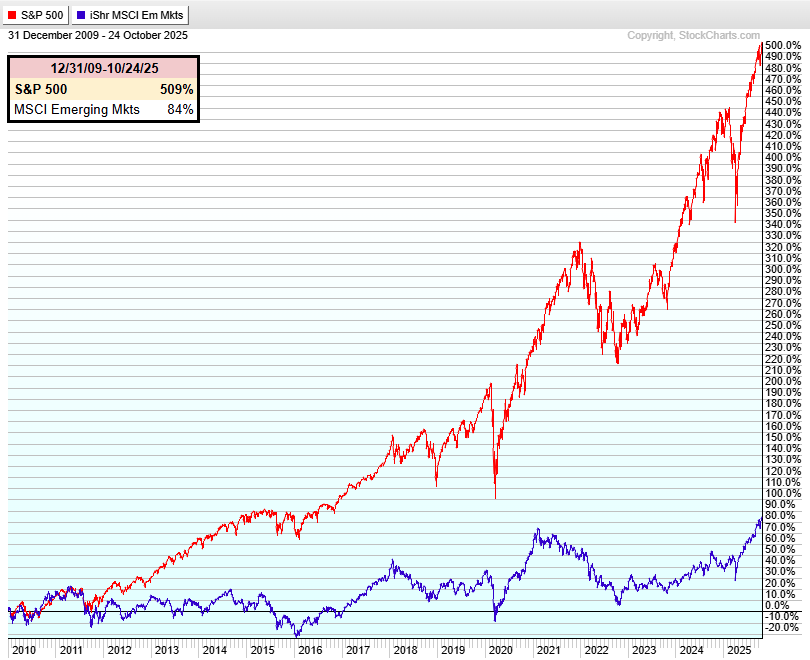

Emerging Markets: This group proved a very high return in 1999 due to investor risk-on sentiment, gave up nearly all the gain in the bear market, but then recovered to new highs by the end of 2003. A long period of underperformance to 2025 has left EM equities at low starting valuations (MSCI EM forward P/E of 13.99 vs 20.39 for MSCI World) and they will benefit from lower US interest rates, easier US monetary policy, and a weaker US dollar). My 2024 article about Hong Kong landlords suggested that HongKong Land was most attractive and it is +93% since then on a price only basis while parent Jardine Matheson is +69%. Volatility may be high, but I believe many multi-year opportunities remain in this area and will try to post more often about them.

Disclosures & Notes

At the time of publication the author held shares of Jardine Matheson. This disclosure should not be interpreted as a recommendation to purchase or avoid any security and this holdings could change at any time. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible.

You can use this Stockcharts link to compare S&P Sector total returns over different time periods.

I have been buying consumer staples... Kraft, Nomad. Might add more. Sizeable position in Kraft. Hope these historical correlations repeat.