Office REITs: Into Darkness

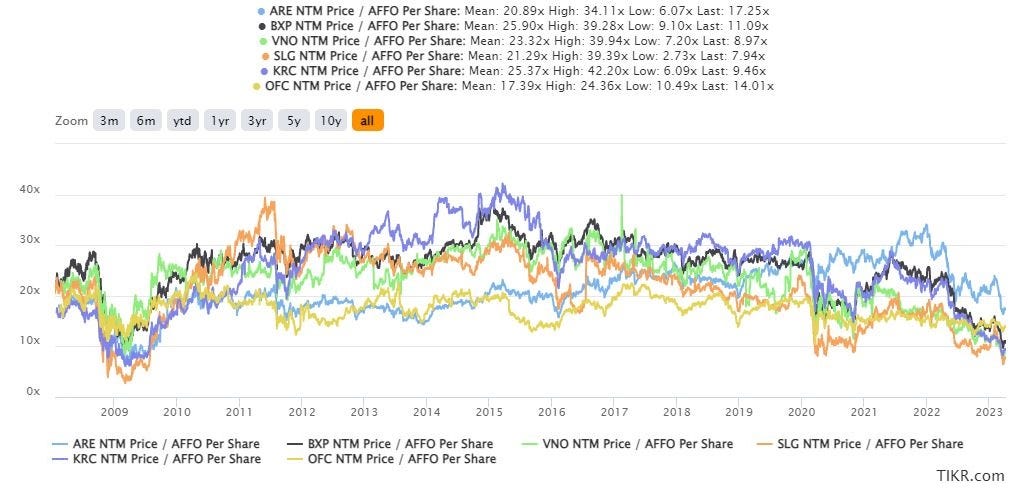

Are Office REITs bargains at Price/AFFO ratios over 50% below their long-term averages? How much pain would you be willing to endure waiting for a recovery?

Prospects for the US Office market have been analyzed in detail by many people with more expertise than me so this article will focus narrowly on several factors that provide perspective on the current investment opportunity in public REITs.

Insiders - Insider buying of Office REITs has not been meaningful.

Lessons from Malls - Only the strongest survive a long fundamental bear market.

Lessons from Calgary - Severe oversupply remains ten years after the peak of a cyclical boom.

Long-term performance of Office REITs - the Office sector delivered poor performance even prior to the recent recession and development of remote work.

Financial Sector Risk - Office values have fallen, but financial sector risk is very limited.

Investment Conclusions - Avoid US Office REITs. BXP is the most attractive.

Canadian Office REITs - Tempting.

To my disappointment I have not found any compelling reason to buy US Office REITs at their current valuations because the sector will need many years to recover from current fundamental challenges. If I were to buy one then it would be Boston Properties (BXP) because it has high quality properties and a strong balance sheet which positions it to build value through the downturn.

INSIDERS

Office REIT share prices and valuation multiples are at multi-year lows, but insiders have been net sellers over the past year:

Each purchase or sale decision will be affected by personal financial circumstances and insiders may be unable to trade due to blackout periods, however REIT insiders are not signaling that share prices have reached bargain levels even after sharp declines.

LESSONS FROM MALLS

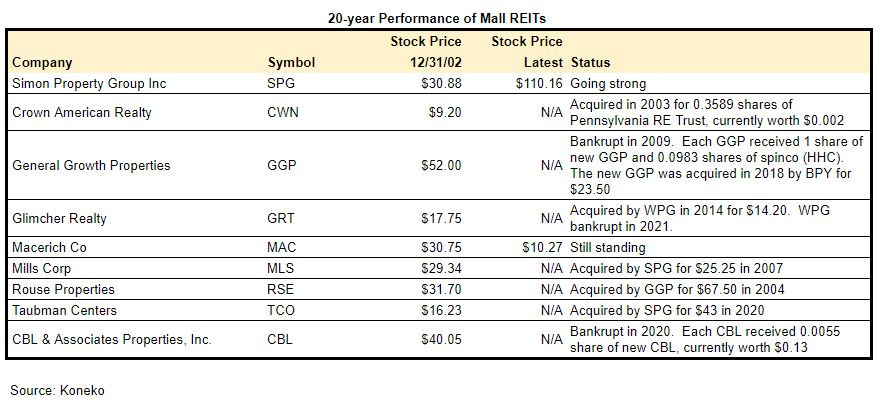

The office sector may have entered an operating environment similar to the malls which suffered from many years of excess supply and declining demand. Of the 9 shopping mall REITs at 12/31/02, 2 went bankrupt with minimal recovery for shareholders, 5 were acquired, and 2 are still operating.

Unsurprisingly the aggregate investor return was poor, but Simon Property Group (SPG) stands out for having delivered an excellent long-term return that beat the REIT sector and the S&P500.

Simon's exceptional performance probably does not get as much attention as it deserves because its sector has been out of favor for so long with the group posting a negative shareholder return 7 of the past 10 years. Balance sheet strength was a critical factor in Simon's ability to navigate sector challenges. The REIT has an investment grade credit rating and usually kept Debt/EBITDA below 7X.

SPG issued shares in 2009 (at $50), 2012 ($137), and 2020 ($72.50). The 2009 and 2020 issues were at low dilutive prices, but guaranteed the REIT would have the financial strength to endure any challenges.

LESSONS FROM CALGARY

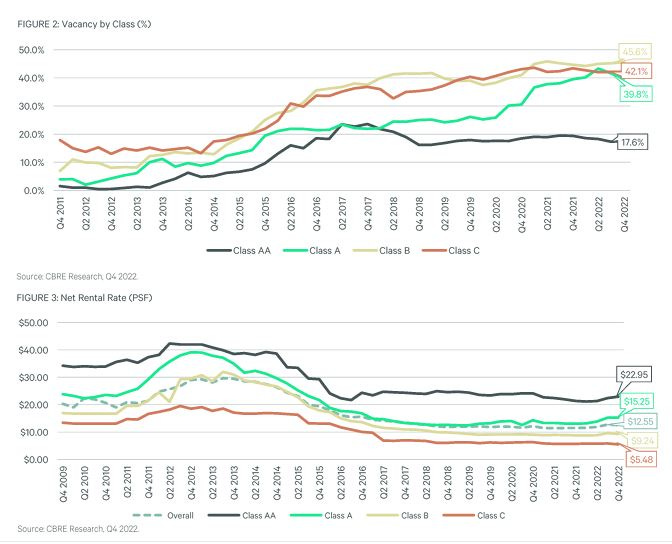

Calgary’s Office market boomed for many years with vacancy for Class A downtown property under 5% until 2013.

Developers responded by launching super-prime towers including The Bow (2012), Telus Sky (2020), Brookfield Place (2017), 707 Fifth (2017), City Centre (2016), and 8th Avenue Place (2014).

Office supply rose as these projects were completed and demand evaporated as the energy sector went into a bear market from 2014. Ten years after the peak downtown vacancy is still over 25%, tenants can have their choice of Class AA space at bargain prices, and rents for non-prime space are barely enough to keep the doors open. The city of Calgary implemented a Downtown Development Incentive Program to incentivize conversion of vacant offices to residential use and even for demolition.

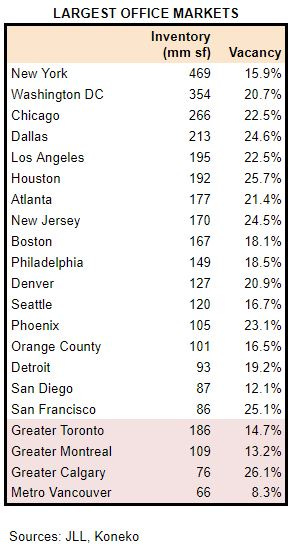

Many US markets now have vacancy rates approaching the level in Calgary:

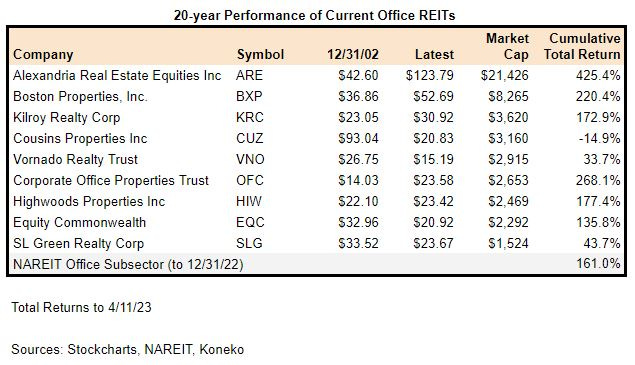

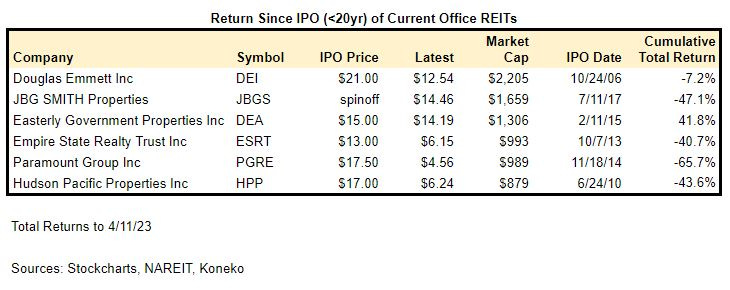

LONG-TERM PERFORMANCE OF OFFICE REITs

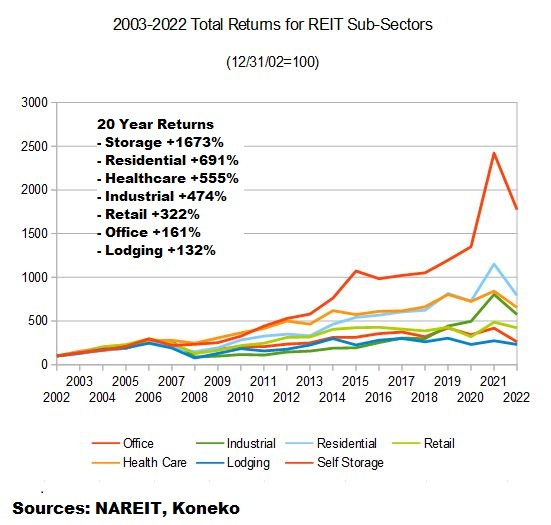

Prior to the pandemic, Office had the second weakest long-term return of any major REIT sector; even slightly below Retail which suffered from well-known problems of tenant bankruptcies and loss of sales to ecommerce.

Most Office REITs have been poor investments for a long time and are not simply suffering from a cyclical downturn and negative investor sentiment.

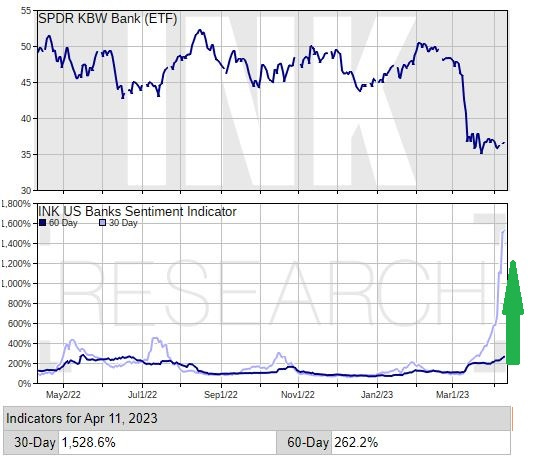

FINANCIAL SECTOR RISK

While the Office sector is likely to be challenged for many years, there is little risk that declining office property values could create a broader financial crisis. Key points from a recent report by Moody’s Analytics:

- Total Banking Sector CRE exposure is only 14.9% of assets

- Banks are well capitalized with the sector’s Tier 1 capital over 13%

- CRE loans have been originated in the past 15 years at lower LTVs than before the GFC. Aside from offices, rents and asset values for most properties have risen.

- Credit losses are likely to be small. Moody’s provides this simple illustration that even a 20% decline in property NOI and a 200bp increase in cap rate would still provide a 98% lender recovery.

The most recent Federal Reserve data shows a delinquency rate on CRE loans held by banks of only 0.68%, slightly above its all-time low:

In contrast to REITs, insiders at US Banks have dramatically stepped up purchases of their own shares. INK Research data shows a 1528.6% ratio of Buy/Sell transactions over the past 30 days:

Bank insider buying has been broad based with over $100k of purchases at 44 different banks.

INVESTMENT CONSIDERATIONS

Office REITs appear “cheap” with valuations near long-term lows, however high vacancy rates will depress rents while financing costs have risen and credit availability has tightened. REITs will be pressured to deleverage through asset sales at low valuations and possibly through dilutive sale of equity in their company or properties.

I don’t see any argument for a quick turnaround. The experience of the Mall sector was that the highest quality company (Simon) proved to be the best investment while “cheaper” peers are all gone. Among Office REITs Boston Properties appears best positioned:

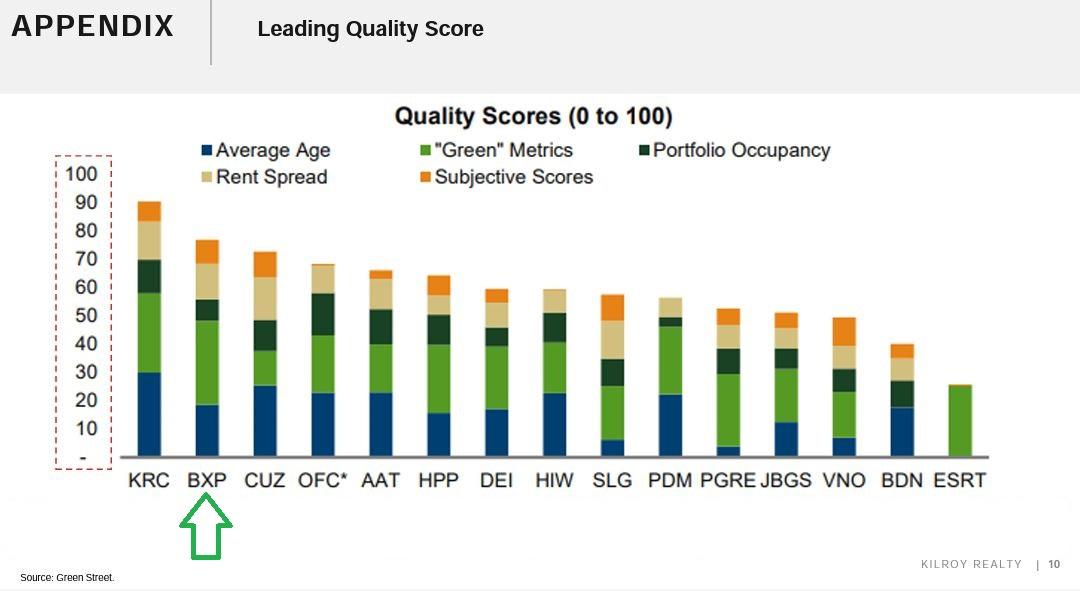

High Quality properties will still draw tenants. Kilroy shares this analysis of the quality of different REIT portfolios:

Low leverage positions a company to avoid distressed sales, forfeitures, and

refinancing at unfavorable rates. BXP’s credit rating of BBB+ is highest among Office REITs, its Debt/EBITDA was 7.6X at 12/31/22, and only 8.1% of its debt is due in 2023-24. BXP is well-positioned to build value by acquiring attractive assets if opportunities become available.

Other Office REITs:

Alexandria looks overvalued with sector leading valuation only modestly below its 15year average, a heavy capex program that it planned to finance with equity issuance, and a contraction of funding available for its Life Science tenants.

Kilroy traditionally traded at a premium valuation due to its financial strength and high quality properties, but it dropped towards sector averages. When or if the outlook for San Francisco stabilizes then KRC could provide a high return with 27% of the REIT’s assets in SF and another 21% in Silicon Valley. John Kilroy's recently announced retirement suggests that fun times are not yet on the horizon.

The NYC REITs (VNO SLG PGRE ESRT) each have some premium assets, but also some fading buildings that may have no equity value. SLG and VNO have high debt levels, but non-recourse liabilities and joint venture structures make them particularly challenging to analyze. Market conditions in NYC are less miserable than most other cities as financial and professional service firms have more in-office workers than tech companies.

Office REITs have been poor long-term performers and now face years of difficult market conditions. There are plenty of more attractive opportunities available in the current market, such as banks.

CANADIAN OFFICE REITs

Canadian landlords face the same challenges as US peers: cyclical recession, remote work, and higher financing costs. However in several respects the Canadian outlook is brighter with better visibility into long-term value generation:

Lower vacancy in major markets (Toronto, Vancouver, Montreal) except Calgary. See earlier table.

Population Growth provides a tailwind for employment and office demand. On a national level the population grew by +2.7% in 2022 (compared to 0.4% in the US) and the increase was concentrated in the major metropolitan office markets.

Redevelopment potential exists to add residential towers above many existing low-rise offices.

The economic advantage of a large growing well-educated workforce at salaries below those in the US is drawing international employers. CBRE estimates that Technology business operating costs in Toronto are 50% lower than the San Francisco Bay Area.

Canada has only two significant Office REITs:

Allied Properties total return of +623% since its 2003 IPO is the best performance of any North American Office REIT. Allied has kept a disciplined focus on renovation of heritage industrial buildings into creative workspace for Technology and Media tenants. In the past 10 years it has grown through adding density above its existing properties (tower at QRC West shown below is one example). Allied is currently offering its three data centers for sale and it’s not the optimal timing, but they are exceptional assets with one being a critical network hub in Toronto. Data center proceeds of about $1.2Bn would leave Allied in very strong condition to build value through the current downturn. Unfortunately, Allied founder/CEO Michael Emory recently announced his retirement and similar to John Kilroy’s decision, the timing suggests that fun times are not yet on the horizon.

Dream Office has a concentrated portfolio in Toronto’s downtown financial district. They are not the largest, newest, or flashiest buildings, but their smaller floor-plates have been more resilient under current market conditions among tenants prizing boutique office space with a Bay Street address. Dream has a current program to enhance building exteriors, common spaces, and neighborhood amenities so that its multiple buildings effectively become a single asset. Dream recently sold one building at a premium valuation and has been aggressively repurchasing its common units. Dream’s total investor return of +246% since 12/31/02 is better than most US Office REITs, but lags Allied. Ten years ago Dream had a much larger portfolio and suffered from high exposure to Calgary and Edmonton. Dream is a currently pursuing zoning applications to add large residential density at several Toronto locations.

DISCLOSURES AND NOTES

At the time of publication the author held shares of Dream Unlimited (the controlling shareholder of Dream Office). The author does not make any recommendation regarding any investment in any company mentioned in this article. Investors are encouraged to check all of the key facts cited here from SEC filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be corrected as promptly as possible. The author may not provide any sort of ongoing coverage or commentary about any company mentioned here.

This article did not address many other important factors that will affect returns from Office REITs including:

Remote Work

Interest Rates

Development Pipelines

Outlook for important tenant sectors (Finance, Technology, Life Science, Government etc…)

Differences between US cities and regions

Great writeup. Thanks!