Canadian Real Estate Year-End 2025

and Updates On All Trade Ideas

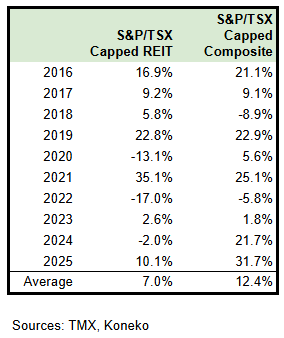

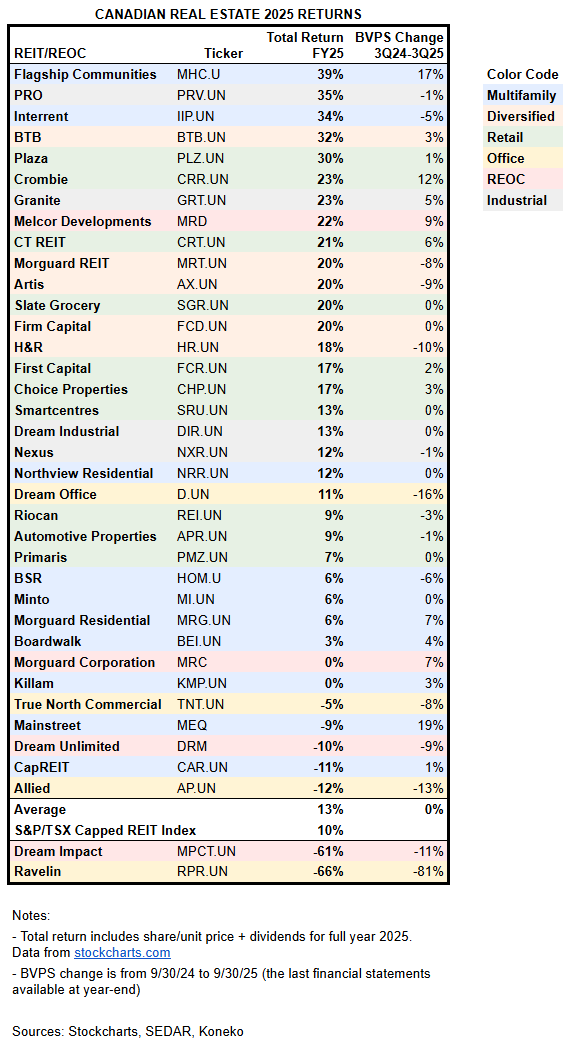

Canadian REITs finished 2025 with a +10.1% total return (S&P/TSX Capped REIT Index), around what investors should expect from the underlying assets and businesses. US Dollar based investors earned an additional +4.9% from currency appreciation. Buying dips was profitable as US tariffs, Canadian politics, and Hudson’s Bay bankruptcy had much less adverse impact than feared. US REITs returned +3.4%.

This article reviews 2025 and long-term sector returns and includes brief comments on all trade ideas mentioned in prior articles, subscriber chat, and notes.

Sector Overview

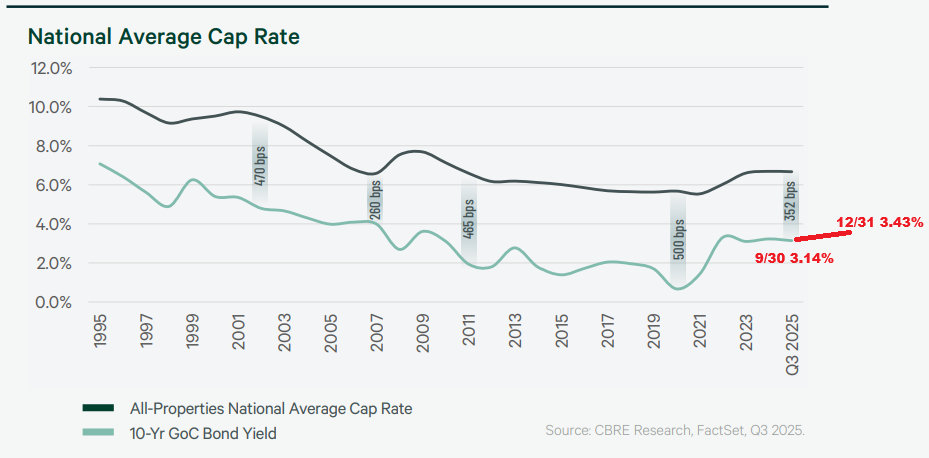

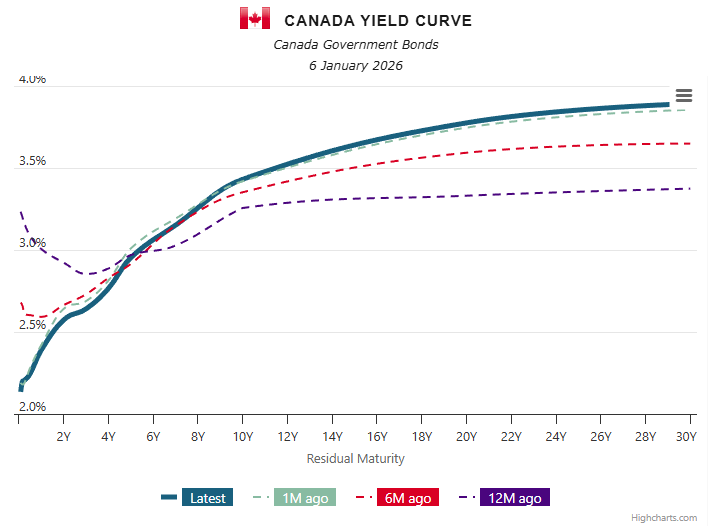

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range, but the 29bp increase in bond yields since 9/30 has been a headwind for interest sensitive securities. Better than expected Canadian GDP and employment data should support income growth in real estate sectors with greater economic sensitivity (Retail and Industrial).

The yield curve has steepened with short maturities sharply lower in the past year (CORRA -102bp, GOC 2-year -35bp GOC 5yr -2bp). A steeper yield curve signals higher future growth expectations that would be more beneficial to economically sensitive Industrial and Retail Assets.

Insiders at 26 of 36 REIT/REOCs were buyers in 2025 and 4 had net insider sales. After very light activity from May-September, buying picked up recently with notable purchases at Killam and Artis. REIT/REOCs have repurchased $866mm of equity in 2025 (reported to 12/31) with the largest buybacks at Artis (4.9% of market cap), CAPREIT (4.9%), Minto (4.6%), and Primaris (4.4%). Some REITs that were aggressive buyers in 1H25 reported no buybacks in September-November (Riocan, Granite, and Minto). CAPREIT resumed purchases in November and bought $89mm.

Topics

REIT Economics - Investment property should provide an average base return of 6.5%. Growth initiatives can raise returns to 8-10%.

REIT Index Returns have averaged 7.0% over the past decade. A simple average of REITs/REOCs produced an above average 2025 return of +13%. The average change in book value per share/unit was +0% so the sector return was entirely due to higher valuations plus dividends.

Canadian Real Estate Trade Ideas Update ($) - Dream Unlimited remains most attractive

Other Trade Ideas Update ($) - Noah, Phenixfin, CSI Properties, Brandywine, Five Points, Ero Copper, Advantage Energy, Cablevision, Star Holdings, Far East Consortium, and Canadian Solar

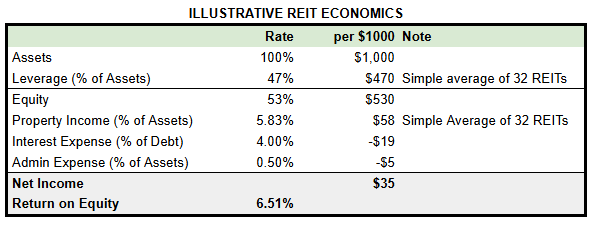

REIT Economics

REITs are a leveraged investment in rental property. This simple model suggests a base return expectation of 6.5%.

Property income (cap rate) varies based on the asset class and could be as low as 4% for some multifamily or as high as 10% for some office.

Interest rate varies based on the credit risk of each issuer and its assets. It can be under 3.5% for high quality short-term debt to 10% or more for distressed situations (RPR and MPCT).

Admin expense varies depending on scale, efficiency, and structure (internal/external management)

Canadian Retail and Industrial property market conditions are healthy with REITs able to earn attractive spreads over their financing cost. Most Canadian multifamily, Canadian office, and US multifamily markets are challenging with small, or even negative, spreads over borrowing costs. Investor returns are more dependent on rent increases.

REITs can enhance the base property return through appreciation of asset values (discounting future rent increases) and accretive investment in acquisitions, development, redevelopment, and unit repurchases. If successful then these could raise return on equity to 8-10% per year.

REIT Returns

Actual REIT total returns have averaged 7.0% over the past decade. This has lagged the target return of 8-10% due to extended weakness in the Canadian economy, rising interest rates, and decline of REIT equities to discounts.

The S&P/TSX Capped REIT index is the weighted return of the 16 largest REITs and was held back in 2025 by poor returns from Allied and CAPREIT. A simple average of 35 REITs/REOCs had a +13% return with 13 earning over +20%. The average change in book value was +0% so a narrowing of discounts was the most important factor in investor returns. There was remarkably little relation between one year book value change and equity return.