Canadian Real Estate and Other Year-End Ideas

Canadian REITs significantly lagged the market in recent months. The S&P/TSX Real Estate index ytd return dropped to +6.3% (XRE to 12/12) due to weakness in multifamily REITs (CAR. BEI, KMP) services companies (Colliers and Firstservice) and disappointing updates from Allied and H&R. US REITs have returned +3.4% ytd.

This article reviews 6 Canadian Real Estate equities and 3 Other equities that are attractive this month. In early 2026 I’ll publish a review of year-end data and a 2026 outlook.

Sector Overview

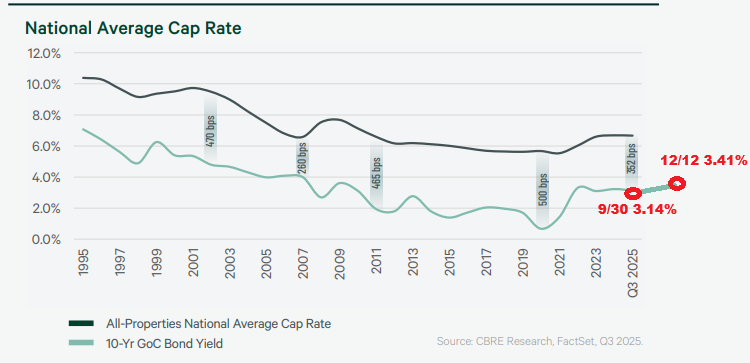

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range, but the 27bp increase in bond yields since 9/30 has been a headwind for interest sensitive securities. Better than expected Canadian GDP and employment data should support income growth in real estate sectors with greater economic sensitivity (Retail and Industrial).

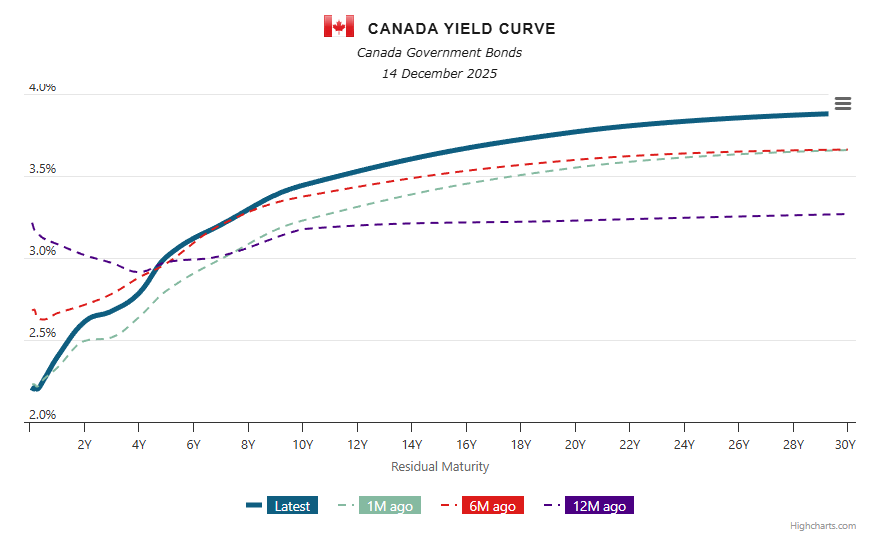

The yield curve remains steep with short maturities sharply lower in the past year (CORRA -104bp, GOC 2-year -41bp). The GIC 5 yr is +3bp yoy.

Insiders at 26 of 36 REIT/REOCs were buyers since 12/31/24 (to 12/12) and 4 had net insider sales. After very light activity from May-September, buying picked up recently with notable purchases at Killam and Artis. REIT/REOCs have repurchased $862mm of equity ytd (reported to 12/12) with the largest buybacks at Artis (5.0% of market cap), CAPREIT (5.0%), Minto (4.8%), and Primaris (4.5%). CAPREIT resumed purchases in November and bought $89mm. Some REITs that were aggressive buyers in 1H25 reported no buybacks in September-November (Riocan, Granite, and Minto).

Topics

Valuation Comparison

Canadian Real Estate Ideas Into Year-End - High conviction in Dream Unlimited

Other Ideas Into Year-End - High conviction in Noah Holdings