Canadian Real Estate 11/14/25

Data is updated for completion of 3Q25 results, commentary on each subsector will hopefully follow by Friday.

Canadian REITs have been a safe haven in 2025 with a total return of +8.4% (XRE to 11/14) after a decline of only -6.7% when US tariff fears peaked in April. US-dollar based investors earned an additional +2.6% through Canadian dollar appreciation. US REITs’ total return has been only +3.5% in 2025.

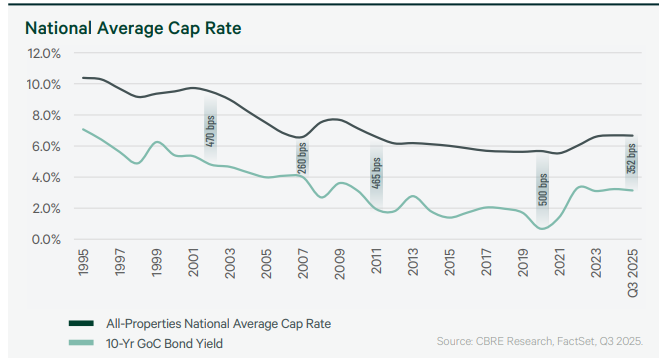

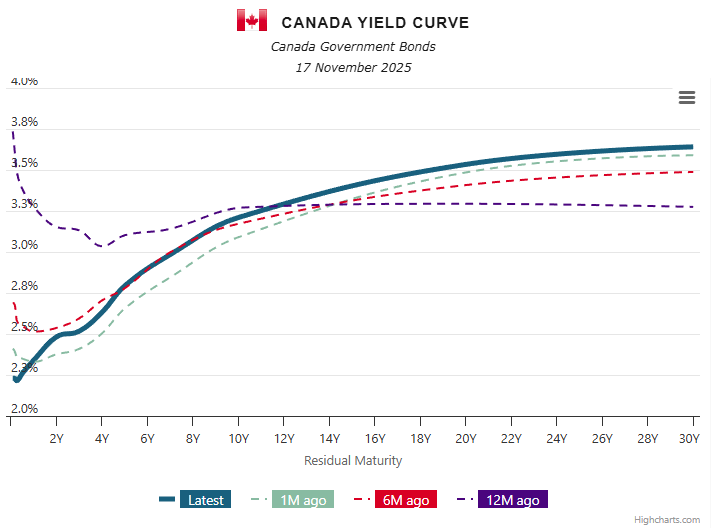

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range (and the GOC yield is +4bp since 9/30/25). However there has been a significant curve steepening with short-term yields corresponding to most REIT debt issuances sharply lower in the past year (CORRA -153bp, GOC 2-year -67bp, and GOC 5-year -31bp).

Insiders at 26 of 37 REIT/REOCs have been buyers since 12/31/24 (to 11/14). Purchases dropped sharply from May-October, but has started to pick up in recent weeks. REIT/REOCs have repurchased $770mm of equity ytd (reported to 11/14) with the largest buybacks at Artis (5.6% of market cap), Minto (4.6%), Primaris (4.5%), and Interrent (4.4% of market cap). Some REITs that were aggressive buyers in 1H25 reported no buybacks in September-October (Riocan, CAPREIT, Granite, and Minto).

The sector remains attractive with many companies able to provide favorable returns through ownership of quality properties and organic growth strategies.

Valuation Comparison

3Q25 results have been reported by 36 of 37 REITs and REOCs. Retail and Industrial results have been strong. Multifamily has been soft due to high supply and weaker demand. Office has been mixed with Dream benefitting more than Allied from Return-to-Office demand this autumn.