Canadian Real Estate 08/01/25 Update

2Q reports and recent news

Canadian REITs have been a safe haven with a ytd total return of +8.4% (XRE to 8/1) and US-dollar based investors earned an additional +4.6% through Canadian dollar appreciation. US REITs’ total return was only +3.8% (IYR to 8/1), and negative for international investors due to the declining US dollar.

Sector Overview

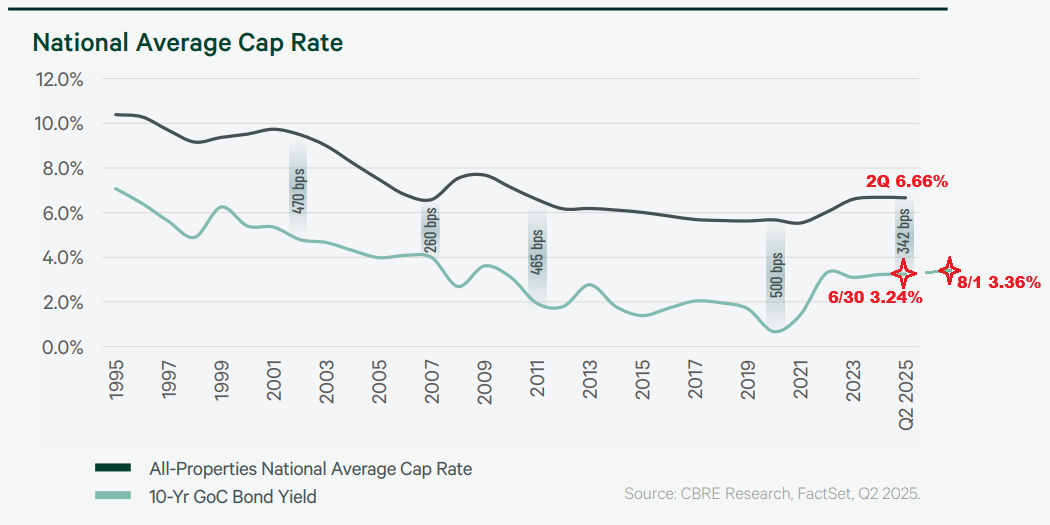

The yield premium of cap rates over 10-year bond yields is near the middle of its historical range. Cap rates are less volatile than bonds - the spread tightens when bond yields rise and expands when bond yields fall.

REIT bond yield spreads continued to improve in 1H25 with spreads for many issuers 150bp below 12/31/23 levels. REITs with access to the unsecured public debt market can refinance on reasonable terms and invest with a positive return on their leverage.

Insiders at 24 of 37 REIT/REOCs have been buyers since 12/31/24 (to 8/1), however buying dropped sharply since April. 4 issuers had small net insider sales. REIT/REOCs repurchased $716mm of units ytd (to 8/1) with the largest buybacks at Interrent (4.3% of market cap), Primaris (4.3%), Artis (4.2%), Minto (4.1%), and Granite (3.1%).

The sector remains attractive with many companies able to provide favorable returns through ownership of quality properties and organic growth strategies. However, the drop in insider activity suggests that investors can be patient and reserve some capital to take advantage of bargains that are periodically created by macro news such as the tariff driven drop in Industrial and the HBC driven drop in Retail.

Topics:

Quick Takes (AP.UN, FCR.UN, PMZ.UN, MRT.UN, MRG.UN, DRR.U,HR.UN)