Artis REIT Merger: Is There Any Substance To Support The Manji Mumbo Jumbo?

The rationale provided by Artis (AX.UN) for its RFA merger has been buzzy adjectives (compelling compounding disciplined diversified durable organic inorganic successful sustainable strategic structurally-advantaged transformational) missing meaningful numbers or nouns that define any value for investors.

A few key details extracted from the opaque 565-page merger proxy:

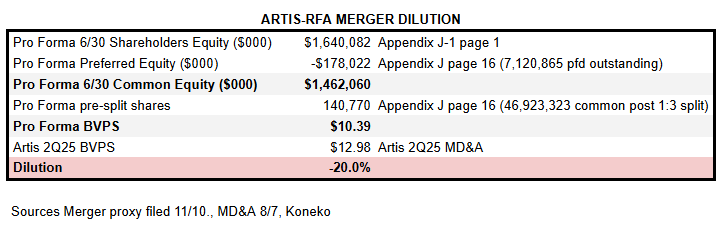

Pro-forma Book Value per share is $10.39. Artis CEO Samir Manji consistently described NAV as a Key Performance Indicator for Artis, but this immediate merger dilution of 20.0% is never disclosed.

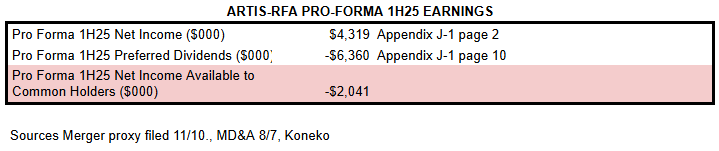

Pro-forma EPS is negative. This contradicts Artis Chairman and RFA CEO Ben Rodney’s claim that the pro forma dividend is “backed by real recurring cash flow and profitability”. It does not look like an opportunity that will draw attention from new investors.

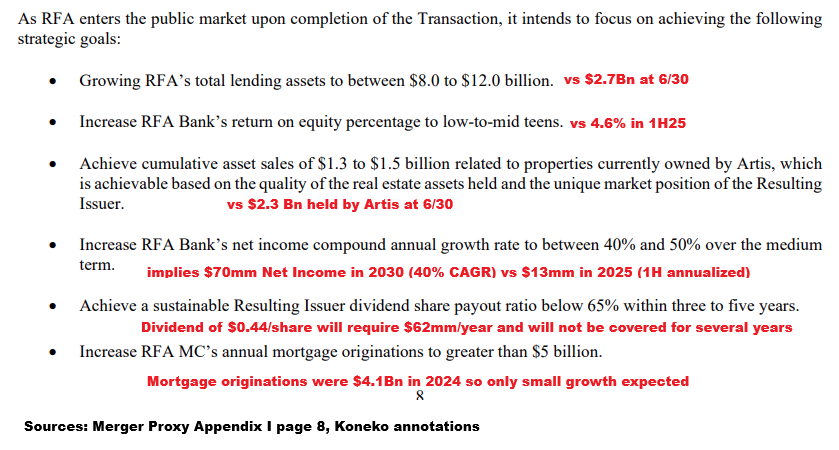

The merger Financial Projections are aspirational and do not include any multi-year model for the post-merger entity. Even if it achieves 3X growth in assets, 3X growth in ROE, and 5X growth in Net Income, the business will still not reach 65% dividend payout ratio.

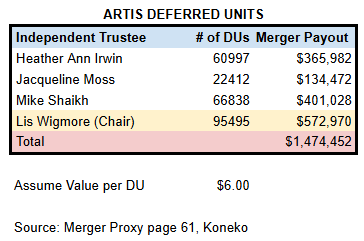

The members of the Artis Special Committee will receive cash payouts totaling $1,474,452 in exchange for their Artis Deferred Units if the merger is completed. They recommend approval of the transaction.

Artis board concluded that “it was unlikely that any other party would be willing to propose an executable transaction on terms more favourable, in the aggregate, to Artis”, but did not consider an orderly liquidation of the remaining real estate portfolio. The RFA transaction assumes that proceeds of $1.3-$1.5Bn can be realized over 3-5 years and invested in the bank. That same amount could presumably have been returned directly to Artis investors.

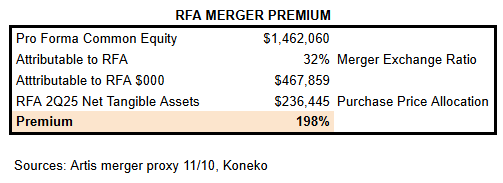

The Exchange Ratio of 68% Artis and 32% RFA was “holistically determined by utilizing market-standard valuation techniques including trading values, recent precedent transactions and discounted cash flow values”, but none of the inputs for the respective valuations of Artis and RFA are disclosed in the proxy. While Artis investors are suffering immediate 20% dilution to BVPS, existing RFA holders are receiving a 198% premium.

The decline in Artis unit price since the merger announcement reflects the unwelcome shift in business model, failure to define the value of the REIT, and failure to define the value of the transaction for investors. It’s possible that the combined business could achieve its goals over a lengthy transition period, however a disproportionate share of the potential merger benefit appears to be paid upfront to RFA. High volume and a recent price jump in the absence of any material developments suggest that an activist may be accumulating a position to push for an alternative. 27mm units have traded since the 9/15 merger news (compared to a float of about 57mm) so there has been considerable turnover of the investor base.

The merger has revealed willingness by the Artis Board and management to abandon the current failing business plan and sell a majority of its assets. If the RFA merger is not completed then those proceeds could be returned to investors and deliver a value approaching the Artis NAV of $12.98 over time.

This article is freely available. Please share with anybody who might be interested.

RFA Capital

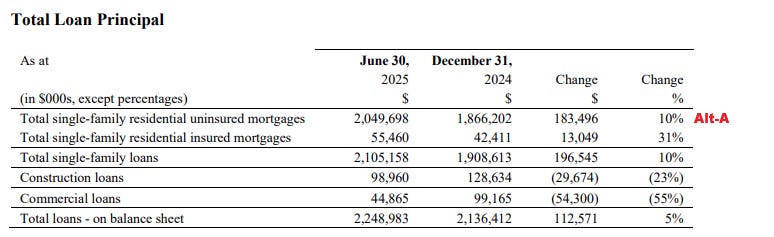

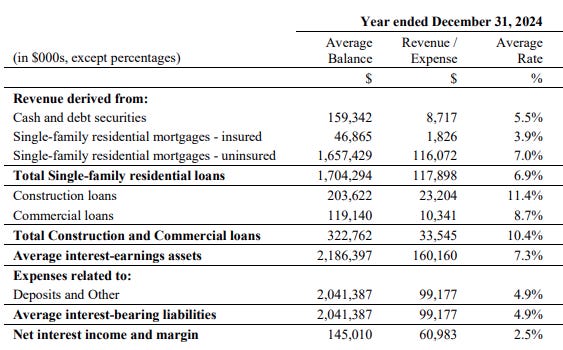

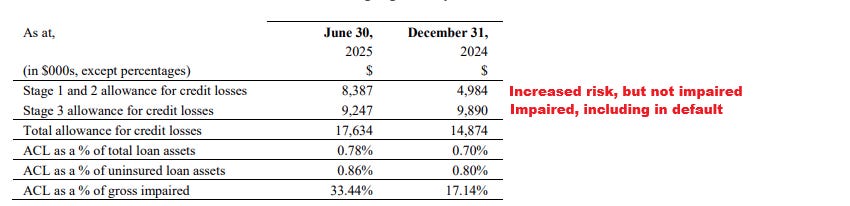

The merger presentation compared RFA to the broad Canadian banking sector, but it has a niche business that primarily uses brokered GICs to fund purchase of brokered Alt-A mortgages. The risks of weaker credit history and income documentation are balanced by low average LTV (64.8% at 6/30) and higher interest rates. Some basic RFA Bank data:

Loan portfolio composition:

Net Interest Margin:

Allowance for Credit Losses:

The downturn in the Canadian housing market raises the risk of loan losses, but RFA has continued reporting profits. 68% of the loan portfolio is in Ontario and the TRREB Composite benchmark GTA home price is 30.5% below its March 2022 peak. The proxy does not mention whether the Artis Special Committee considered the risk of rising credit losses in the existing RFA portfolio.

The premise of the merger is that RFA has a platform that could grow profitably with access to additional capital. That may be completely correct! But the proxy provides no explanation for the valuation attributed to RFA in the transaction.

Artis

The RFA merger is the second unexpected and unwelcome strategic surprise from Artis. In March 2021 the REIT announced a Business Transformation Plan under which it would sell a portion of its existing portfolio and invest the proceeds in real estate value investments. It was best-in-class creative clearly-defined unconventional pioneering strategic high-conviction dramatic patient thoughtful calculated opportunistic disciplined bold simpler stronger and will get the flywheel churning in a direction that grows our intrinsic value and cash distributions to our owners.

The value investing plan featured significant stakes in Cominar, Dream Office, and First Capital that lost money in aggregate. Artis has a leftover portfolio after selling its most marketable assets:

Industrial 44 properties, of which 25 are in Winnipeg and 16 in AB+BC+SK

Office 30 properties, of which 19 are in Minnesota and Wisconsin

Retail 18 properties in AB+SK+MB

Residential 1 property in Winnipeg

The only common theme connecting many of these remaining holdings is that the pre-2021 Artis management team was based in Winnipeg and especially fond of assets in that area. None of them are especially attractive or valuable. There’s no strategic value to holding them in a single entity and there’s no logical buyer for the entire portfolio. It seems wise and hopefully feasible to realize proceeds of $1.3-1.5Bn over 3-5 years as envisioned in the RFA merger transaction. The question for the Artis Board and unitholders is what to do with the proceeds.

Unitholder Vote:

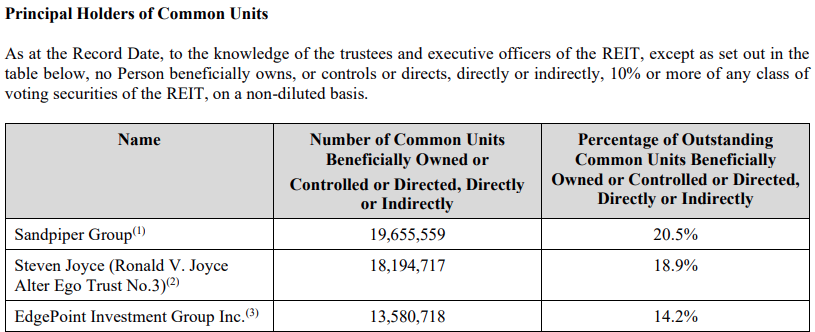

The RFA merger will require an affirmative vote from 2/3 of outstanding Artis units. The largest holders are:

At the unitholder meeting, units held by Artis Chairman Ben Rodney will be excluded because he is deemed an interested party due to his simultaneous role as CEO of RFA. I was told that Ben Rodney was appointed to the Artis board at the request of Steven Joyce. Joyce owns 18.9% of Artis and also owns 30.9% of RFA, but is not deemed an interested party for purposes of approval of the transaction. Perhaps that can be challenged. Sandpiper has no stake in RFA.

If Edgepoint votes in favor of the deal then it will certainly go through. If they oppose the current deal terms because they don’t like losing money then it could be difficult for Artis to reach 2/3 approval. Participation in votes with a lot of retail holders tends to be low.

Background Documents:

Merger Announcement 9/15 Press Release

Merger Announcement 9/15 Presentation

Merger Announcement Conference Call Transcript (no questions allowed)

Merger Proxy filed 11/10

Disclosures and Notes:

At the time of publication the author held units of Artis REIT. This disclosure should not be interpreted as a recommendation to purchase this security and this holding may change at any time. Investors are encouraged to check all of the key facts cited here from SEDAR filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication.

A link to this article was sent to Artis Investor Relations at the time of publication. As a current Artis unitholder I do not wish to spread misinformation or misunderstanding about the REIT. If they can point to any factual errors using information publicly available at the time of publication then corrections will be made as promptly as possible.

I don't follow how Halcyon/Steven Joyce is not an interested party in this transaction and their votes shouldn't count. As of December 2024, "RFACHIL is owned directly by RFA Capital Holdings Inc. (RFA) and indirectly by RFA's largest shareholder, Halcyon International and Mr. Steven Joyce." If Ben Rodney is excluded from voting for this transaction, then shouldn't RFA's largest shareholder also be excluded? Arguably, Sandpiper should also be excluded as Samir will be the Board Chair following this transaction (CEO to Chair seems like it is also an insider on this transaction). The independents getting cash for deferred units instead of locked up stock is also pretty bad (if it is such a good deal, then hold the stock and pay the tax on your DSU's). https://www.newsfilecorp.com/release/232258/RFA-Capital-Holdings-International-Ltd.-Successfully-Closes-the-Previously-Announced-51-Interest-in-Five-Continents-Financial-Limited-in-the-Cayman-Islands

Good article. Would be funny, to see the deal blocked by a corporate raider (Manji was supposed to the "corporate raider.") Studied Artis pretty extensively and luckily never lost money on it despite being down for some time over a couple year hold period. Embarrassed a bit to admit I was bullish on it and thought a SIB could be coming at one point. Thought the insider buying was bullish then came the index deletion. Was great to follow all their transactions to see how liquid the markets were in various asset classes. Really liked Manji’s idea of selling assets to private market to invest in other out of favor REITs but he chose the wrong pony in Dream Office & also the Cominar portfolio. Still think he did a good job getting out of his self-imposed hole but this latest maneuver adds depths to sketchiness. An office REIT with a sub prime lender, hard to imagine how that will be received positively. It seems the US offices have no transaction liquidity until now. If there is, why wouldn't Samir be selling those? Ultimately no hard feelings on Samir Manji, as I got out unscathed, but if I stuck with him I'd be pretty livid over that deal as I believe Artis could 'easily' be liquidated at least $10 or higher based on recent market comparables.