Arlington Asset Investment: Mortgage REIT at a 60% NAV Discount and Positioned For Sale or Liquidation

Arlington Asset Investment (AAIC) has no competitive advantage and has generated a negative long-term shareholder return. I estimate that liquidation could return $5.55/share (+114% return vs 5/17 price) with a majority of proceeds available within a few months.

Reasons to expect something may happen:

A shareholder proposal for liquidation of the REIT received significant support at last year’s Annual Meeting

Over the past year the REIT has disposed its more complex investments leaving a clean and lightly levered portfolio

AAIC has not held investor conference calls in 2023 and has not filed a Annual Meeting proxy (prior years always filed by 5/4)

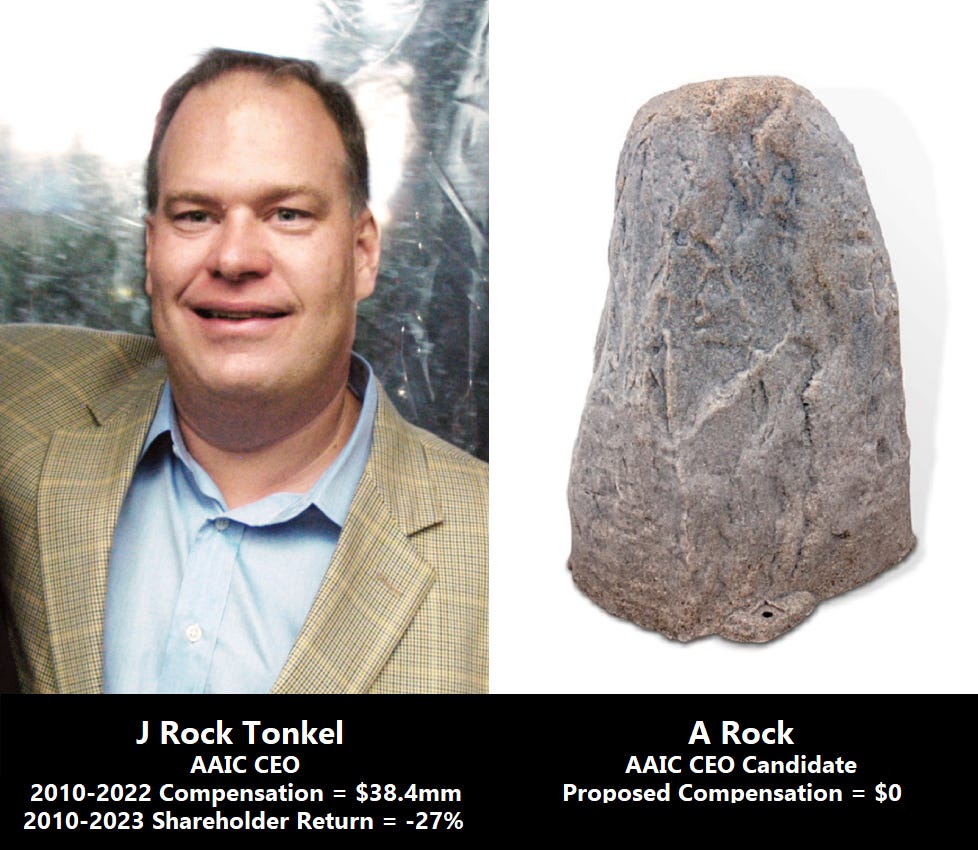

If AAIC does not pursue a liquidation or other corporate event to deliver value to shareholders then it will likely be a poor investment due to excessive compensation. I believe one path to improvement would be through replacement of AAIC’s CEO J Rock Tonkel with a candidate I have identified:

Topics:

AAIC History

2022 Proxy Proposal for Liquidation

AAIC Assets

AAIC Liabilities & Capital

Possible Outcomes

AAIC History

Arlington Asset is the reorganized surviving entity from the investment bank Freidman Billings Ramsey which spun out its capital market business in 2009. From 2010-2022 AAIC reported cumulative Net Income Available to Common Stock of $33mm, issued $520mm in equity, paid $503mm in dividends, and paid $82.6mm in compensation to its “named executive officers” (NEOs).

2022 Compensation of $7.27mm paid to CEO J Rock Tonkel and CFO Richard Konzmann was 3.3% of average Stockholders Equity and 275% of Net Income Available To Common Stock.

An AAIC shareholder at 12/31/2009 who reinvested all dividends would have a cumulative return of -27% compared to +39% for the Mortgage REIT ETF or +373% for the S&P500.

2022 Proxy Proposal for Liquidation

AAIC’s 2022 proxy statement filed on 5/2/22 included a shareholder proposal for liquidation of the company:

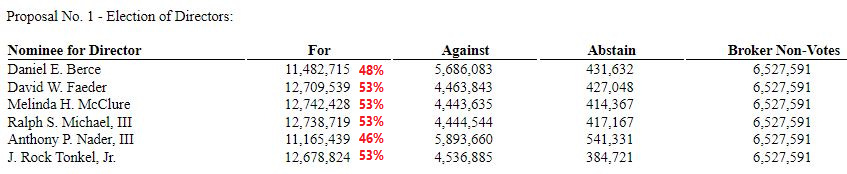

The proponent held 4.6% of AAIC’s shares, but had no other record as a shareholder or activist and made no public campaign. Frankly, a much stronger case could have been made in favor of the proposal. Nevertheless it received a very impressive level of support:

Shareholders also expressed significant opposition to the unopposed slate of Directors:

Last year’s proxy showed all officers and directors held a combined 4.8% of shares outstanding. The most recently reported independent shareholdings show no stake friendly to management. Gator Capital acquired most of its stake in 1Q23 and could seek to catalyze change.

AAIC Assets

While AAIC’s directors offered feeble arguments against last year’s liquidation proposal, the company has quietly shrunk its portfolio and exited its more complex assets. It appears to be liquidating.

Single Family Rental Portfolio - AAIC sold its entire portfolio of 586 homes in two bulk transactions in 4Q22.

Non-QM Residential Lending - AAIC held a $25mm net investment at 12/31/22 in first-loss securitization interests backed by non-qualified residential mortgages. The position was sold in 1Q23.

AAIC’s remaining assets are:

Excess MSRs - AAIC purchased the right to excess returns from MSR’s backed by agency mortgages. AAIC has the right to terminate the agreement at any time.

Credit Investments has three meaningful holdings:

$50mm AAA-rated CMBS secured by a first lien mortgage on The Mark Hotel in NYC

$49mm AAA-rated CMBS secured by a first lien mortgage on “The Streets at Southport” super-regional mall in Durham NC (owned by Brookfield Properties)

$29mm Nursing home loan. The first-lien loan was due 3/23/23, but the borrower was granted a 3 month extension and an additional 3 month extension option beyond that.

Agency MBS - nothing special

The MSRs, CMBS, and Agency MBS are easily marketable. Hopefully the nursing home loan will pay off soon.

AAIC’s poor long term performance has left it with tax NOLs that could provide limited value to a new business plan:

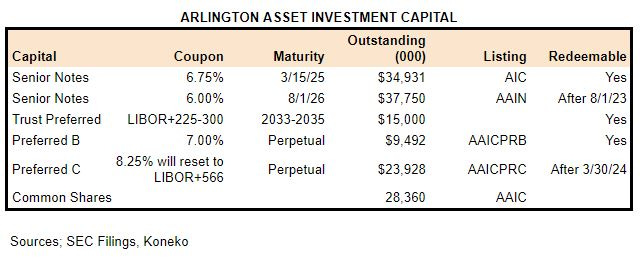

AAIC Liabilities and Capital

AAIC’s capital stack could be appealing to a new management team:

AAIC’s common equity has a book value of $182mm. The coupons on the senior notes, trust preferred, and preferred B are significantly below the current cost of capital for mortgage REITs and well below the mid-teens returns currently available from leveraged mortgage investments (according to MREIT 1Q23 conference calls).

AAIC’s liability to executives upon a change of control is $9.8mm ($0.35/share). Considering the company’s terrible long-term return it would be money well spent.

AAIC had a total of nine employees at 12/31/22 so severance for the remaining seven would not be a significant burden. Long-term contractual obligations (leases etc…) were only $185k at 12/31/22.

Possible Outcomes

AAIC has not disclosed any consideration of strategic alternatives, however the company has not reinvested the capital realized from recent asset sales, did not hold conference calls after 4Q22 and 1Q23 results, and has not yet issued a proxy for a 2023 shareholder meeting. Something’s up (as usual it’s not the AAIC stock price).

Acquisition - Laggard mortgage REITs have often been acquired by larger peers as a way to grow the capital of the surviving entity. An externally managed acquiror may be willing to pay a cash premium to the shareholders if the target is internally managed (like AAIC). Shareholders of an acquired company are more likely to receive fair value in a stock acquisition if the acquiror has strong demand for its shares (e.g. NLY) than if it is less well known (e.g. RC). With most mortgage REITs currently trading at large discounts to book value there are just a few potential buyers for AAIC that might be willing to pay a discount of 15-25% to book value.

Liquidation - Most of AAIC’s remaining assets could be liquidated within a short time. A rough estimate of proceeds available to shareholders suggests potential proceeds of a 13% discount to book value.

Going Concern - AAIC’s poor long-term return and ridiculous NEO compensation make this the highest risk and least desirable outcome. Nevertheless, in last year’s proxy statement the Directors stated:

AAIC’s board should compare the value received in any potential merger (including the risk of a decline in the value of merger consideration paid in stock) against the value that could be realized through liquidation (including the risk of a decline in the value of assets and the time required to sell assets and dissolve the entity).

Disclosures & Notes

At the time of publication the author held shares of Arlington Asset Investment. The author does not make any recommendation regarding any investment in any company mentioned in this article. Investors are encouraged to check all of the key facts cited here from SEC filings and other sources prior to making any investment decisions. The author believes all information in the article is accurate as of the date of publication. Any factual errors in the article will be correctly as promptly as possible.

These AAIC directors bear ultimate responsibility for the company’s pathetic long-term shareholder return and excessive executive compensation:

Daniel Berce, CEO of GM Financial Company

David Faeder, Chairman of Federal Realty

Melinda McClure, lead independent director of Independence Realty

Ralph Michael, Chairman of Fifth Third Bank (Greater Cincinnatti)

Anthony Nader, Managing Director of SwaN & Legend Venture Partners

It’s up to these Directors to pick the right Rock to lead this company going forward. Shutting this company would remove its embarrassing performance from their public resumes.

Good stuff! I've been anticipating something of this nature for a little more than a year...wish it had only been a few weeks!

This was an outstanding article. I was looking for the same catalyst. You really did a great job putting this report together. I hope it got some extra traffic after I linked it on Seeking Alpha.